Risk/Reward Rating: Positive

AngloGold Ashanti is nearing the end of a transition phase which laid the foundation for a high-quality growth investment in gold. The company is the third largest gold producer in the world with a strong balance sheet, minimal debt, and a growth profile. With 21% total production growth expected through 2025, AngloGold stands apart from the largest producers which are projecting flat gold production over this period. Further adding to the allure, AngloGold trades at a fraction of the valuation of the largest producers.

Valuation: 7x 2021 expected earnings with a 2.47% dividend yield. For comparison, the two largest gold producers, Newmont Mining and Barrick Gold, trade at 19x and 16x 2021 earnings estimates, respectively. The valuation discount is extreme as things stand.

The valuation discount is in part due to the transition phase that AngloGold is exiting. They became undisciplined in the prior gold bull market that ended in 2011 and took on excessive debt levels and made unproductive capital allocation decisions. More recently, AngloGold removed their CEO in 2020 due to questionable personal decisions which created a cloud of uncertainty.

On the plus side, capital allocation decisions have become more rigorous and debt levels have been brought down to minimal levels (0.37x adjusted EBITDA: earnings before interest, taxes, depreciation, and amortization). Additionally, the company has announced a new CEO beginning September 2021, Alberto Calderon, who appears well-suited for the future of AngloGold.

The new CEO has extensive and diverse experience across the mining industry generally. While not specifically gold mining per se, his most recent position was leading the world’s largest commercial explosives company based in Australia, which is heavily used in mining. This provided a bird’s eye view of the global mining industry from the supply side.

Mr. Calderon also led a division of BHP Billiton in Africa, one of the world’s largest natural resource companies. He has extensive education in economics most recently at Yale and has worked with global institutions such as the World Bank. Finally, his home country is Columbia where he ran the largest in-country mining operation (coal). This will serve AngloGold well as they have several promising growth projects underway in Columbia which includes copper. Throughout his career, Mr. Calderon has operational experience in the geographies hosting AngloGold’s primary operations: Africa, Australia, and South America.

New leadership at this moment aligns well with entering a growth phase for the company. One of the largest high-quality gold deposits in the world at Obuasi in Ghana is close to restarting after being idled for many years (part of the transition period). The reconstruction is 97% complete and the company targets 400,000 ounces of gold per year on average. The deposit holds 30 million ounces.

AngloGold has many notable world-class mines that deserve mention. Geita in Tanzania is a flagship mine producing 623,000 ounces per year and is in a prolific gold region. Kibali in the DRC of Africa is one of the largest mines of its kind. It is operated by Barrick Gold while AngloGold retains 45% ownership. The mine produces 365,000 ounces per year and has further potential. Sunrise Dam in Australia produces 256,000 ounces per year and has excellent growth potential in the Western Australian gold fields. Finally, Tropicana is also in the Western Australia gold fields and produces 298,000 ounces and is 70% owned by AngloGold.

As mentioned, the largest gold producers are projecting flat production over the coming decade. This is due to the difficulty, risk, and capital intensity of finding and developing high-quality gold mines. Given the depletion of existing mines, growth is difficult to maintain for larger producers. The current valuation multiple for AngloGold is a fraction of that for the largest gold miners. At the depressed valuation, AngloGold could become an interesting takeover candidate as it would be immediately accretive to earnings given the valuation discrepancy. An acquirer could then achieve additional earnings leverage through operational efficiencies.

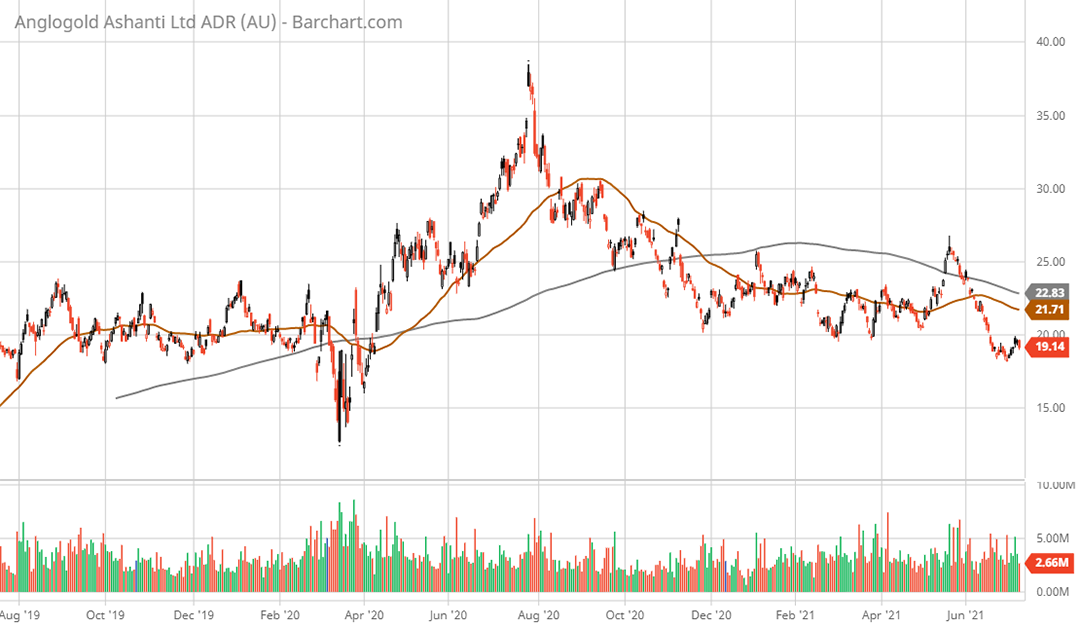

Technical backdrop: AngloGold has been in a correction and base building phase since the gold bull market top in 2011. Between 2014 and 2020, the stock has carved out a broad W bottom which should provide a solid foundation (see the 20-year monthly chart). The top of this W pattern was in the high teens to $20 area. AngloGold finally broke out of this base to the upside in April of 2020. The stock is currently testing support in this breakout zone.

Technical resistance: $26 to $30 area is first resistance followed by the $36 to $40 zone.

Technical support: Current levels in the high teens and low $20’s area. This has been strong support in recent years (see the 2-year daily chart) and is the breakout level from the six-year W base which should offer further support.

Price as of report date 7-8-21: $19

AngloGold Ashanti Investor Relations Website: AngloGold Ashanti Investor Relations

All data in this report is compiled from the AngloGold Ashanti investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.