While reading Amazon’s annual letter, written by CEO Andy Jassy, I could not shake the thought of the 1960’s conglomerate bloom. The conglomerate boom coincided with an easy credit, low interest environment against the tailwinds of a postwar baby boom. This boom is similar in many respects to the economic cycle that began in 2009 and peaked in 2021. The recent cycle included the influence of the millennial generation entering the labor force en masse.

Bird of Paradise

The flower above is that of a Bird of Paradise. Like conglomerates such as Amazon, Birds of Paradise flourish under very specific conditions.

The temperature range required for a Bird of Paradise to flourish is quite limited at 65 to 70 degrees Fahrenheit. The plant thrives in only two US climate zones, 10 and 11. The following map from the US Department of Agriculture displays the plant hardiness climate zones.

Notice the tiny footprint of Zone 10 in the continental United States, represented by the orange-shaded areas of Florida, Texas, and the West Coast. Furthermore, Zone 11 is only present in portions of Hawaii and Puerto Rico.

Is Amazon a Bird of Paradise?

Like the Bird of Paradise, conglomerates flourish only under certain conditions. And in returning to the Jassy letter, the comparison of Amazon to a conglomerate is inescapable. The defining feature of a conglomerate is having a widely dispersed and largely unrelated portfolio of businesses. I alluded to Amazon reaching its full bloom as a conglomerate in October 2021, in a report titled “Amazon is lost in the jungle.” The following passage is how I opened the piece, emphasis added:

I am assigning Amazon (NASDAQ: AMZN) a negative risk/reward rating based on a heightened risk of underperforming consensus estimates in the coming quarters, an elevated valuation, and the possibility of a historically low return growth investment cycle.

Further on in the report:

It should be noted that Amazon has a history of erratic profitability due to periodic growth investment ramps. This pattern tends to reduce the concern amongst investors when profitability turns lower as they expect the investments to produce outsized gains… caution is in order this time.

Finally, the example in the following passage from the report captures the essence of the conglomerate problem, emphasis added:

Many of these investments are in physical supply chain buildout (more similar to FedEx and UPS) rather than in technology infrastructure buildout (think higher margin AWS).

In viewing Amazon’s valuation in the October 2021 report, I used six comparable companies: Walmart, Kroger, UPS, Netflix, Microsoft, and Google. Upon reading Jassy’s 2022 annual letter, the following comparable companies can be safely added to the list: Verizon, United Health Group, Nvidia, Meta Platforms, The Trade Desk, Costco, PayPal, Teladoc, and Space X.

If this does not describe a conglomerate, I contest that there must be no such thing.

A Conglomerate

A casual glance at Amazon’s comparable companies reveals the structural growth limitations inherent in the conglomerate business model. The end result of mixing such a vast list of industries together can be nothing other than average, at best. While it is possible to dominate such a large number of industries, the historical evidence reaffirms the underlying logic. Conglomerate business models inherently achieve average outcomes.

In fact, I am unaware of any historical evidence to the contrary. The most successful conglomerate to date is Berkshire Hathaway. Looking at Berkshire’s portfolio, I would wager that Warren Buffett agrees that Berkshire’s results are highly likely to be average going forward. That is, when compared to the performance of the broad market-cap-weighted indices.

In fact, Berkshire’s largest holding, at near half of its portfolio value, is the largest company in the US indices, Apple. Interestingly, Apple itself looks to be transforming into a conglomerate in its own right.

Amazon is Lost in the Jungle

The following two paragraphs are a paraphrase of the summary section of the October 2021 Amazon report, “Amazon is lost in the jungle.” It will serve as a foundation for viewing the changes to consensus growth estimates since October 2021.

Amazon was arguably the largest beneficiary of the COVID lockdowns by absolute revenue growth. It was the perfect storm for Amazon to take market share. As COVID recedes into the rearview mirror, Amazon investors face a period of heightened risk as the reversion to underlying organic growth takes hold.

The risk level is further amplified by the aggressive growth investment plan being implemented. Amazon is investing heavily in physical infrastructure and employees compared to prior growth investment cycles. This sets up the potential for rapidly increasing costs at a time of historic growth deceleration, leaving profitability exposed to substantial disappointment.

Consensus Estimate Trends

In fact, using consensus earnings estimates changes since October 2021, Amazon’s profitability has substantially disappointed. The following table displays today’s consensus estimates for earnings (top) and sales (bottom) through 2027. For each, the percentage change in estimates since October 2021 is displayed.

I have highlighted the 2025 estimate changes in yellow as they capture the essence of consensus estimate reductions. Earnings estimates have more than halved while sales estimates are down in the mid-teens percentage range. Notice that Amazon’s PE multiple has expanded by 42% to accommodate the lower earnings estimates (highlighted in blue in the upper section of the table).

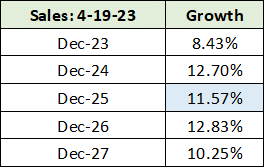

Interestingly, Amazon’s valuation based on sales has compressed by 25% to 1.5x (highlighted in blue). For reference, Costco trades at a premium earnings valuation while trading at 0.9x sales. Walmart trades at 0.65x sales today. The following table displays consensus estimates for sales growth through 2027. I have highlighted 2025 in blue for ease of comparison with the 2025 PE multiple in the above table.

AWS

Of foremost concern to Amazon is the AWS segment. As discussed in the October 2021 report, emphasis added:

AWS margins are materially contracting… This segment is the cornerstone of Amazon’s profitability at 54% of total operating income on only 13% of total sales. As a result, the operating income margin in the AWS segment is a key performance indicator to monitor in future reports.

AWS sales are near $85 billion annually and are now facing sales growth headwinds. From the Jassy letter:

AWS faces short-term headwinds right now as companies are being more cautious in spending given the challenging, current macroeconomic conditions.

Margins will be critical in order for AWS to remain the cornerstone of Amazon. Here, the Jassy letter suggests that the margin compression at AWS (highlighted in the October 2021 report) is continuing:

While some companies might obsess over how they could extract as much money from customers as possible in these tight times, it’s neither what customers want nor best for customers in the long term, so we’re taking a different tack.

Summary

With high single-digit to low double-digit sales growth expected into mid-decade, it may be safe to say that Amazon is past full bloom. Recent AWS growth challenges lend support to this conclusion. Regardless, in viewing Amazon’s list of comparable companies, it is most certainly a conglomerate that has reached full bloom.

History would suggest that conglomerates, like Birds of Paradise, only flourish under tightly controlled conditions. In the end, all conglomerates reach full bloom and are average at best.