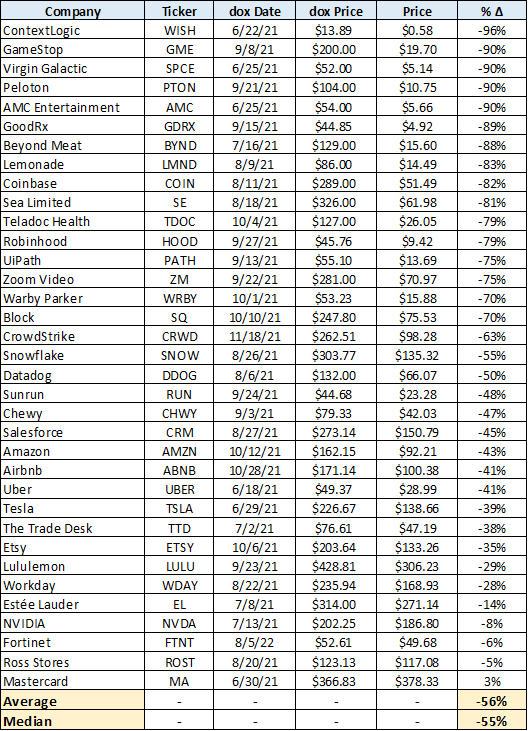

There are 38 companies that have received a negative risk/reward rating at stoxdox since we began publishing in June 2021. As our goal is to cover the most asymmetric risk/reward opportunities of our time, the vast majority of the negative ratings occurred in 2021. The asymmetry across the broad market at the time was to the downside.

Negative Risk/Reward Ratings

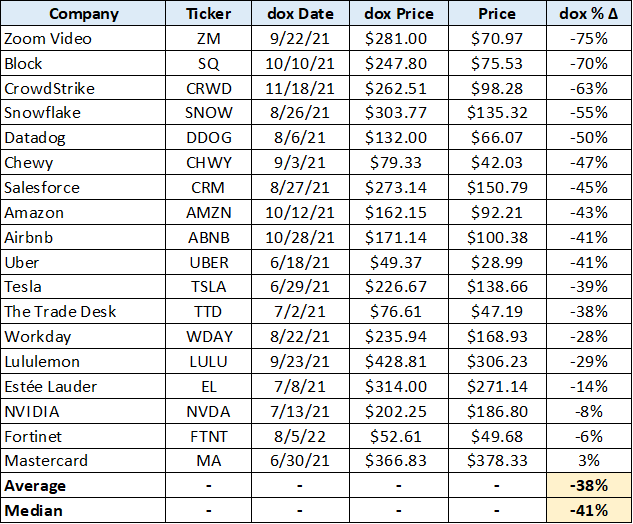

As the markets have bounced materially off the October 2022 bottom, now is a good time to circle back and review the negative ratings and search for opportunities. The following table displays all of the stocks that received a negative risk/reward rating in their initial stoxdox report and have yet to be reviewed with a rating change.

Please note that the ‘dox Date’ and ‘dox Price’ columns are the date of the initial report and the price as of the report. The ‘% ∆’ column is the return from the report date through January 23, excluding dividends.

I have highlighted in yellow the average and median performance since the initial report date. Mastercard (NYSE:MA) is the only stock that is positive following a negative risk/reward rating. Please note that there are 35 companies in the above table.

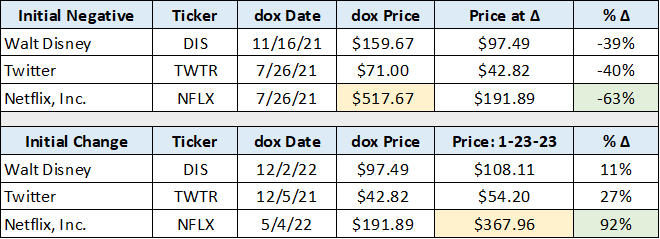

There are three stocks that were initially rated negative and have since been reviewed with a rating change. The three companies are summarized below. Note that the upper table reflects the initial negative rating through the rating change, and the lower section displays data since the rating change. The ∆ symbol stands for change.

I have highlighted Netflix (NASDAQ:NFLX) for illustrative purposes as it has been reviewed on three separate occasions. It received a negative risk/reward rating on July 26, 2021; a positive risk/reward rating on May 4, 2022; and a neutral rating on December 3, 2022. While the shares remain -29% beneath the original negative risk/reward rating price of $517.67, the volatility has created extraordinary portfolio management opportunities (highlighted in green).

Disney (NYSE:DIS) and Twitter received neutral ratings in their updates. Twitter was later acquired while Disney has since tested beneath its key support level of $90, as expected. From the December 2022 Disney update: “The significant reduction in profitability estimates since November 2021 has opened the door to tests below the low $90s.” The shares bottomed at $84 on December 28, 2022.

Three Groups

Excluding the three companies that have subsequently been updated with a rating change, the remaining companies can be categorized into two broad groups. The groups are related to the primary driver of the negative risk/reward rating for each company: valuation and business model.

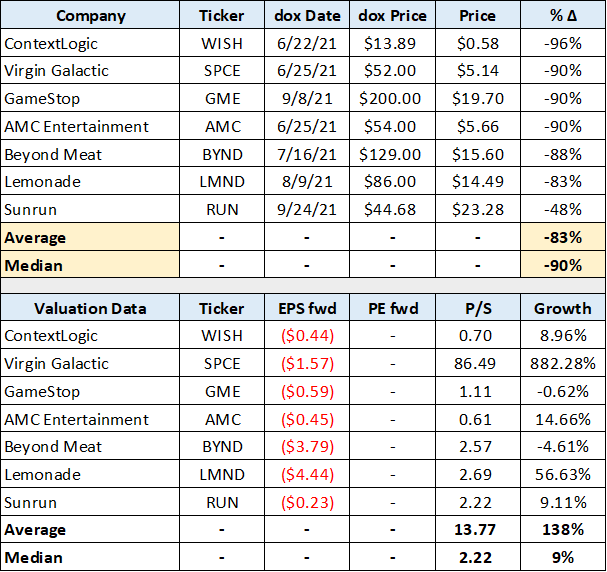

Business Model

In terms of nearer term opportunities, the negative ratings tied to valuation are the most fertile ground, while those with business model questions require more time. The business model group further divides into two categories: impaired and possible.

Impaired business models are those that offer little to no visible opportunity and include the following:

The above firms are unlikely to be reviewed in the future as the probability of success is too low given the unprofitable business models in place. Notice in the lower portion of the table that all are expected to remain unprofitable in the coming year. The growth column displays consensus sales growth estimates for the coming year. Virgin Galactic (NYSE:SPCE) is coming off a zero base and is thus not meaningful, while Lemonade’s (NYSE:LMND) growth remains structurally unprofitable.

Even after the large stock market bounce off the October 2022 bottom, the median return for the group remains at -90%. Of these companies, Beyond Meat (NASDAQ:BYND) likely has the most turnaround potential followed by Lemonade. Although there are currently no signs of such a reversal for either.

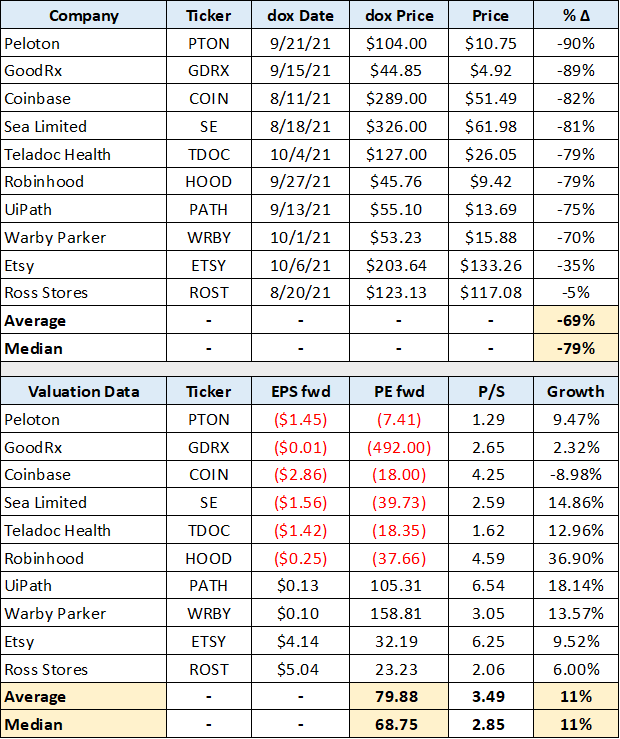

Possible Opportunities

There may be future opportunities in companies that received a negative rating for which business model success remains a possibility. The following table displays the companies in this group.

Although it is still too early to review the above firms, I can offer brief commentary on each. Several companies fit into what I would call brand opportunities. These include Peloton (NASDAQ:PTON), GoodRx (NASDAQ:GDRX), Teladoc (NYSE:TDOC), and Warby Parker (NYSE:WRBY). Brand is perhaps the most powerful value lever available to corporations. I will look to update these companies if a positive business model resolution appears to be at hand.

There are many idiosyncratic business model risks above. In retail, Ross Stores (NASDAQ:ROST) may be nearing maturity which creates a heightened risk of prolonged multiple contraction, which could mirror that experienced by department stores over the past decade. Etsy (NASDAQ:ETSY) participates in a volatile, low margin retail business which is likely to place a ceiling on its valuation potential. Finally, Coinbase (NASDAQ:COIN) is dependent on retail cryptocurrency trading volumes, which are erratic by nature and have collapsed.

On the technology front, UiPath (NYSE:PATH) and Sea Ltd. (NYSE:SE) could become opportunities given their end market growth potential, though more time is needed. Similarly, Robinhood (NASDAQ:HOOD) could become an opportunity if it can stabilize its business model with a focus on higher margin growth. The potential opportunity in Robinhood is tied to its 20 million plus users. A sustainable business plan with higher margin, non-brokerage growth would warrant a review.

Valuation

The final category includes those companies with negative risk/reward ratings which were largely due to valuation. This is the group from which Netflix, Disney, and Twitter originated, and subsequently were each upgraded from negative. As evidenced by these three companies, portfolio opportunities in the group can be material.

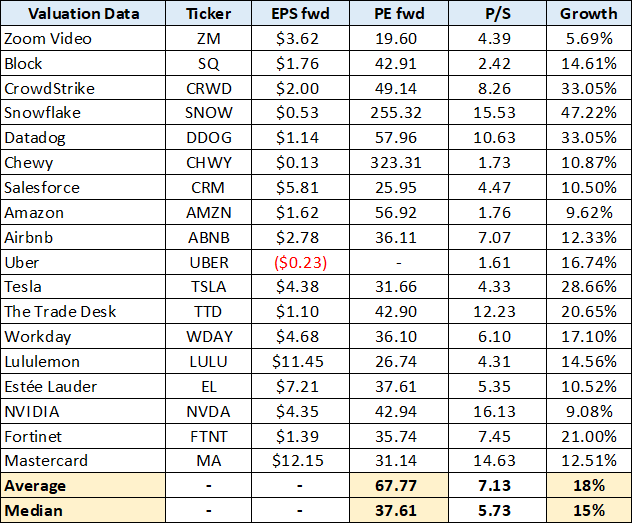

The following tables display the negative risk/reward rated companies in the valuation group. Performance since the negative rating is summarized in the first table and the relevant valuation data based on consensus estimates is displayed in the second. Please note that the growth column in the lower table and in the tables above represents the consensus sales growth estimate for the coming year.

I have highlighted in yellow the forward PE and sales growth statistics for the group. A casual glance confirms that there is more time required for most valuations to normalize. With a group median PE of 38 on 15% expected sales growth, the valuations remain rich to say the least.

On the valuation front, Zoom (NASDAQ:ZM) stands out as a potential opportunity. If one excludes Zoom’s net cash position of over $5 billion from the valuation, it is trading at 15x the consensus estimate for the coming year. Given the valuation and signs of a technical bottom being in progress, I will cover Zoom in a follow up report. It presents a neutral risk/reward opportunity at worst and is trending toward positive.

Amazon (NASDAQ:AMZN) is the second company in the above group for which valuation has largely normalized. In the case of Amazon, I am referring to its P/S (price-to-sales ratio) reaching 1.76, as its earnings are an unreliable gauge given the stage of its recent expansion cycle. In the October 2021 report, the downside potential was estimated to be near $100. The shares recently bottomed near $82. Like Zoom, Amazon is a neutral risk/reward opportunity at worst and is trending toward positive.

Stocks in the above list for which valuation remains the primary headwind include the following: Block, Crowdstrike, Snowflake, Datadog, Tesla, The Trade Desk, Workday, Estee Lauder, NVIDIA, Fortinet, and Mastercard. While many of these companies continue to offer exceptional sales growth potential, the growth rates are rapidly decelerating leaving the valuation risk elevated. In the case of Tesla (NASDAQ:TSLA), the consensus earnings estimate looks to be at material risk of disappointment while execution risks are extreme given its rapid capacity expansion in what is a mature and cyclical industry.

Companies in the above list that are less exposed to valuation risk and are trending to a more neutral risk/reward rating include the following: Chewy, Salesforce, Airbnb, Uber, and Lululemon. While Airbnb (NASDAQ:ABNB) remains at an elevated valuation, the company has potential network effects which could render valuation a secondary concern. Uber (NYSE:UBER) has similar network effect potential assuming it can become structurally profitable.

Airbnb and Uber may yet become the big winners of the gig economy era. As a result, I will look to update them in a timely manner. Salesforce (NYSE:CRM) and Lululemon (NASDAQ:LULU) are straightforward from here and are largely a matter of valuation and technicals. Finally, Chewy could become a more attractive brand opportunity. For now, it remains in a low margin business which will likely place a ceiling on its valuation and thus return potential.

Summary

One out of 38 negative risk/reward rated stocks is up since the initial stoxdox report. This is an unusual success rate under normal market conditions. It is likely tied to the extreme valuation starting point.

Nonetheless, at the time of the reports, the negative risk/reward asymmetry was not evident to the market. This is exemplified by the likes of Amazon, Salesforce, Lululemon, Netflix, Disney, and Tesla. Each of these companies was a market darling at the time of their negative risk/reward rating, and exemplifies the value that we strive to provide to our members.