Filter the Noise: Where Are We in the Cycle?

It may be surprising that the psychological stock market peak occurred in March 2021, while the bond market peaked in August 2020. These peaks occurred 18 and 24 months ago, respectively. During this historic topping process, information providers were overflowing with outlandish stories of the future and untethered optimism. This was the time of maximum risk.

Today, the investment information pendulum is beginning to move toward maximum fear, as the extreme risks of 18 to 24 months ago fully materialize. During such times of market stress, the purveyors of fear and doom will be elevated to the front page and given prime media placement.

The optimal time for risk mitigation ended long ago. Now is the time to search for signals amongst the noise as the greatest opportunities of the next cycle are born.

A Top Sector Opportunity for the Next Cycle

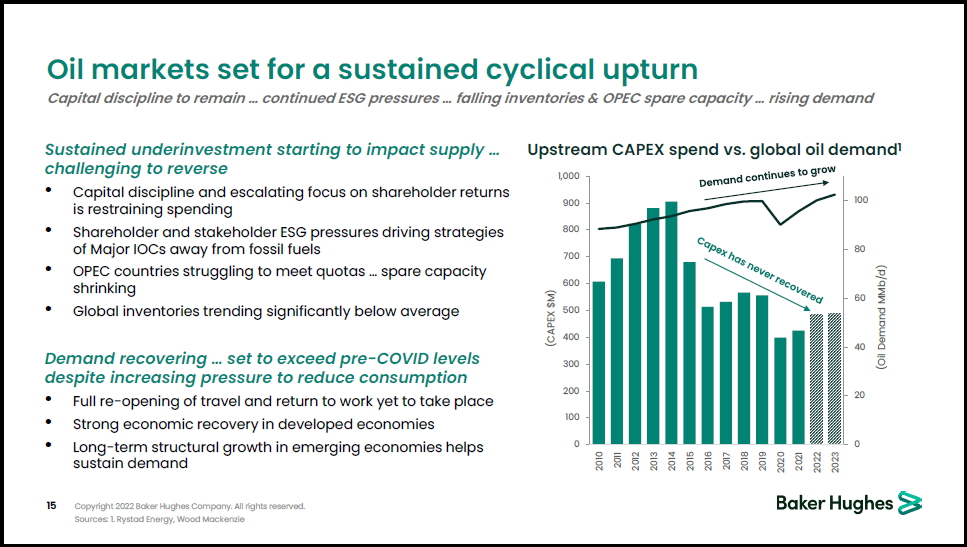

The energy services and equipment sector stands out as a top choice for the coming cycle. Technically, it is the “oil and gas equipment and services industry” in today’s parlance. I refer to the group as energy services and equipment because it better describes the evolving nature of the industry as the energy transition is creating secular growth opportunities. The following slide from the Baker Hughes (NASDAQ:BKR) May 2022 investor presentation captures the essence of the bullish fundamental backdrop for the industry.

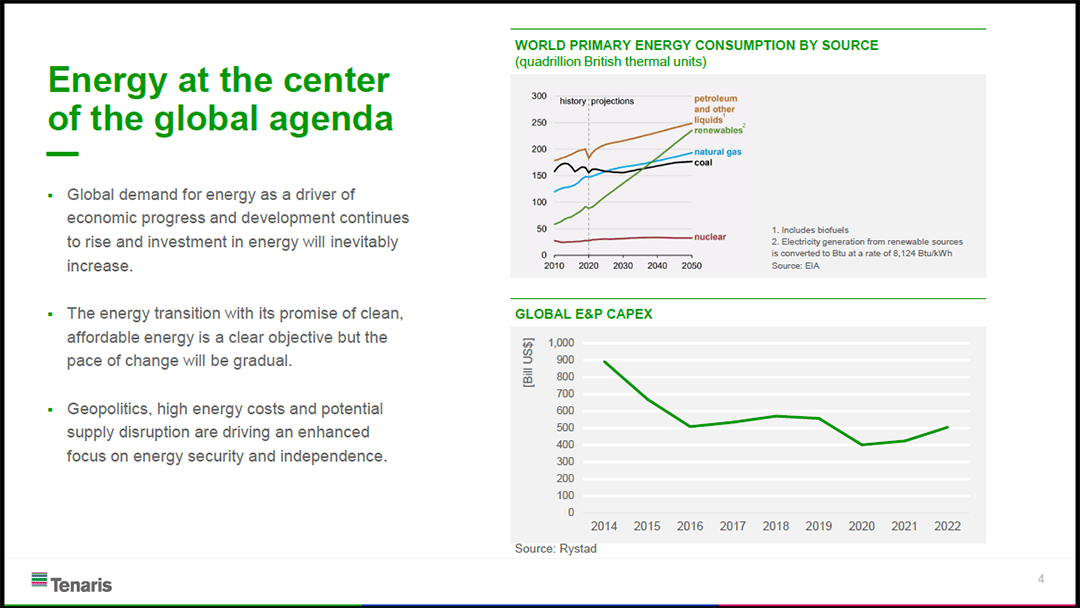

On the right-hand side of the slide, notice that global oil and gas capex fell from $900 billion in 2014 to $500 billion in 2016. It stayed there until crashing to $400 billion during the 2020 to 2021 pandemic period. At roughly $500 billion currently, oil and gas capex remains below the level of 2010 and near half of the 2014 peak. Importantly, global oil and gas demand is expected to grow through 2050, as can be seen in the upper-right side of the following slide from the Tenaris (NYSE:TS) September 2022 presentation.

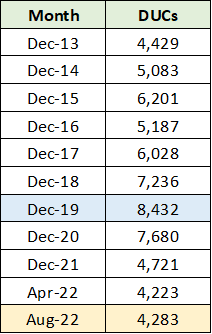

In essence, the oil and gas sector is in maintenance mode. The long bear market that began in 2014 and ended with negative oil prices in 2020 has created a risk averse environment. When combined with the global energy transition, there is little incentive for oil and gas companies to invest for growth. The lack of investment is on display in the table below which summarizes the drilled but uncompleted wells data for the US, or DUCs. The data was compiled from the US EIA (U.S. Energy Information Administration).

I have highlighted the most recent DUC count in yellow and the peak in blue. Oil and gas producers in the US are restricting available well inventory to the lowest levels in a decade, and beneath the level reached in 2013. The following quote from Baker Hughes’ Chairman and CEO, Lorenzo Simonelli, in the company’s Q2 2022 earnings transcript, perfectly summarizes the fundamental industry backdrop (emphasis added):

On one hand, the demand outlook for the next 12 to 18 months is deteriorating, as inflation erodes consumer purchasing power and central banks aggressively raise interest rates to combat inflation. On the other hand, due to years of underinvestment globally and the potential need to replace Russian barrels, broader supply constraints can realistically keep commodity prices at elevated levels, even in a scenario of moderate demand destruction… higher spending is required to re-order the global energy map and likely offsets moderate demand destruction in most recessionary scenarios.

Simonelli is describing the objectively bullish supply and demand conditions in the energy services and equipment industry. A recession is almost immaterial to the sector given the long recessionary period and prolonged underinvestment in oil and gas. Olivier Le Peuch, Schlumberger’s (NYSE:SLB) CEO, hints at this possibility in Schlumberger’s Q4 2021 8-K filed with the SEC (emphasis added):

Looking ahead into 2022, the industry macro fundamentals are very favorable, due to the combination of projected steady demand recovery, an increasingly tight supply market… These favorable market conditions are strikingly similar to those experienced during the last industry supercycle, suggesting that resurgent global demand-led capital spending will result in an exceptional multiyear growth cycle.

For a sense of the investment requirements, unconventional wells exhibit a hyperbolic decline curve during the first five years of production as discussed in this Journal of Petroleum Technology article, “Life After 5: How Tight-Oil Wells Grow Old,” by Trent Jacobs. US gas wells are estimated to decline by 28% in year one while oil well production is expected to decline by 34% in the first year. 75% of US oil production is estimated to be produced from wells brought online over the previous two years.

At the time the journal article was published, January 31, 2021, there were 93,000 oil wells drilled between 2010 and 2017 that accounted for the remaining 25% of US oil production. The following quote from the article sums up the situation facing the oil and gas producers:

“Base decline is the volume that oil and gas producers need to add from new wells just to stay where they are—it is the speed of the treadmill,” said Raoul LeBlanc, vice president of the unconventional oil and gas unit at IHS.

With US DUCs down 50%, the US oil and gas industry is likely to rebuild available well inventory, as the treadmill requires. All signs point to the early innings of a material upcycle for oil and gas capex. The energy services and equipment industry is the prime beneficiary as commodity price gains dissipate for the energy producers.

Cyclical Growth and Margin Expansion

The cyclical upswing is unfolding while the industry is operating conservatively given the long bear market. Clay Williams, the Chairman and CEO of NOV (NYSE:NOV), described it well in the company’s Q2 2022 earnings release:

Diminished global oil and gas inventories and productive capacity; rising energy security risks; and higher commodity prices are spurring increased oilfield activity. However, the industry is struggling to ramp up following years of downsizing and underinvestment… As the early phase of this up-cycle advances…

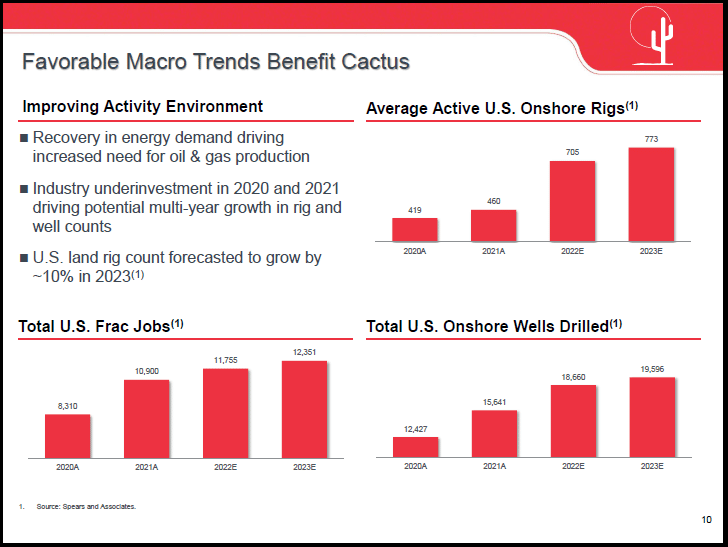

The early stage nature of the upcycle is supported in the following slide from the Cactus (NYSE:WHD) September 2022 investor presentation. 2022 marked the first year of growth for the US drilling upcycle with moderate growth projected thereafter.

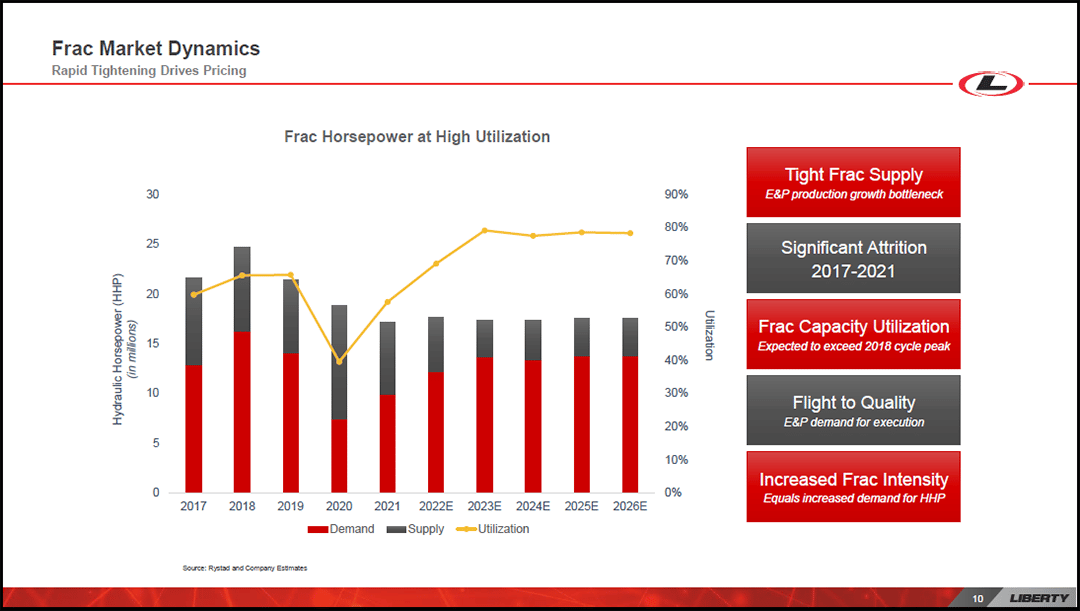

The limited ability to bring on additional capacity near term is supported in the following slide from the Liberty (NYSE:LBRT) September 2022 investor presentation. Conditions are rapidly tightening on the services and equipment side, which should continue to support pricing power for the foreseeable future.

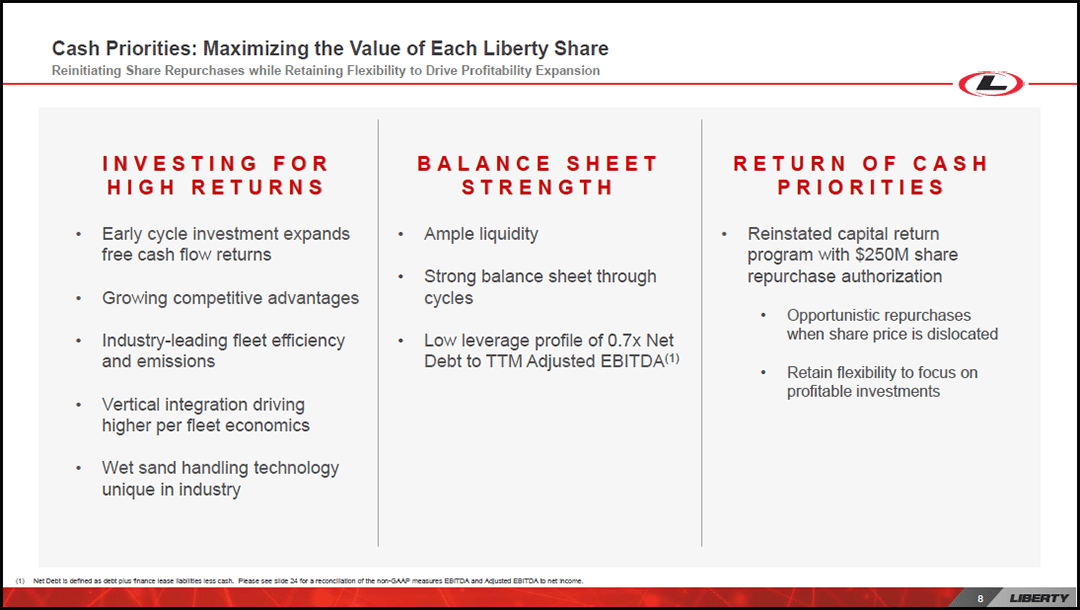

Notice on the following slide from the same presentation, that Liberty has authorized a substantial share buyback program at 10% of its current market capitalization. The industry is squarely focused on improving shareholder returns as the new upcycle unfolds.

Though conditions are tightening and leading to enhanced pricing power, the long bear market has created a more conservative industry. Demand could begin to stress supply creating an exceptional operating environment for the energy service and equipment industry.

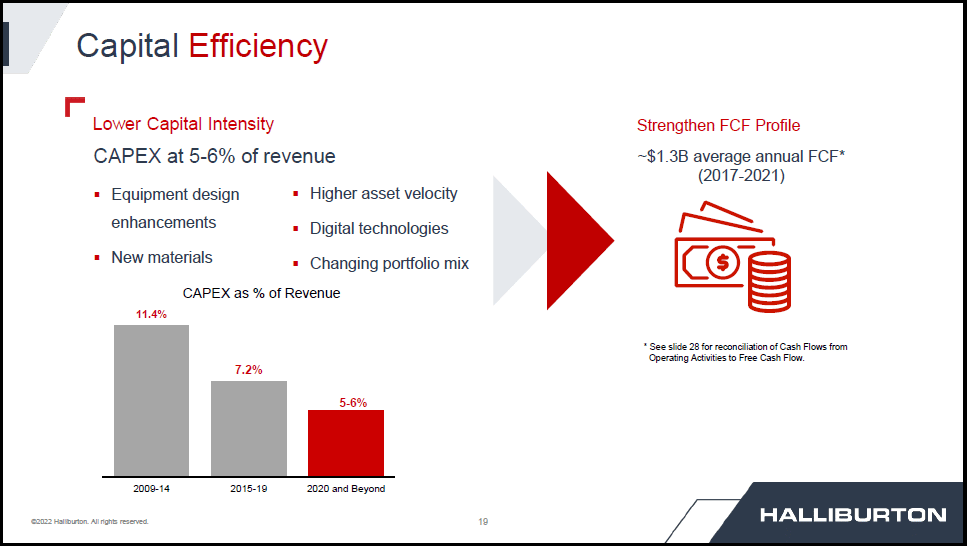

Haliburton (NYSE:HAL) is materially reducing its capital expenditure plans compared to the prior upcycle between 2009 and 2014, as can be seen in the following slides from its Q2 2022 investor presentation . The sole focus remains on improving free cash flow and shareholder returns.

The Energy Transition: Secular Growth

As exemplified by Liberty and Halliburton above, the energy services and equipment industry is focused on returns rather than growth in the oil and gas sector. This is decidedly not the case outside of oil and gas. In fact, the energy transition is creating secular growth opportunities for the industry. The following sequence of slides from NOV’s September 2021 investor presentation tell the secular growth story quite well. In the first slide, notice that oil and gas represent a minority of the opportunity set for NOV and the energy services and equipment industry broadly.

NOV’s deep experience in offshore oil and gas makes it particularly well suited for the offshore wind energy market. Offshore wind installations are expected to explode through 2030 as can be seen on the next slide.

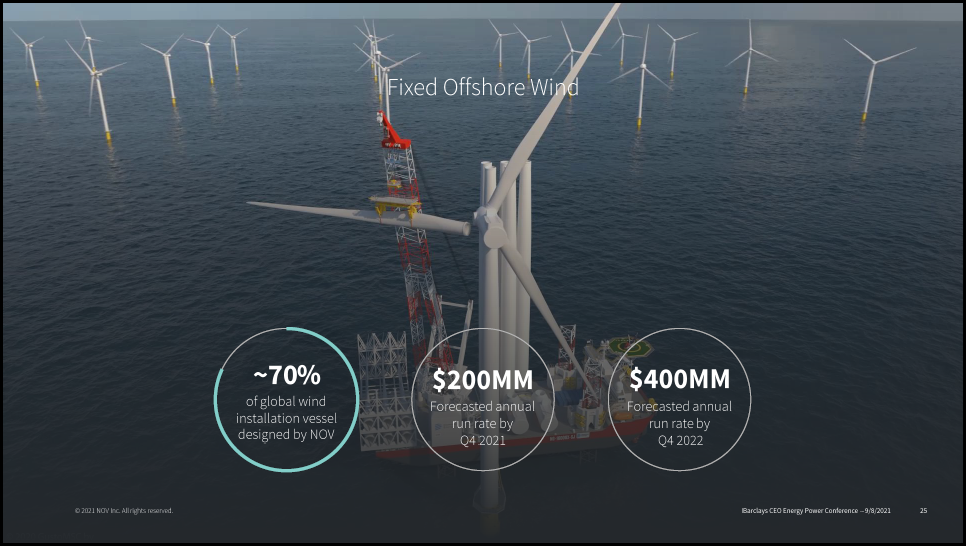

On the next slide, notice that NOV is expecting 100% growth from the offshore wind market, while 70% of vessels used by the industry to date were designed by NOV.

NOV has a competitive advantage in fixed and floating offshore wind as can be seen on the next slide.

The company is also targeting the onshore wind market with a new plant in Texas.

Keep in mind that wind is just one secular growth opportunity for NOV and the industry overall. The energy services and equipment industry is perfectly positioned for many energy transition growth opportunities including geothermal, solar, biogas, hydrogen, and carbon capture.

Simonelli, Baker Hughes’ CEO, confirmed the industry’s focus on secular growth opportunities while maximizing returns in the oil and gas sector. The following quote is from the Q2 2022 earnings transcript (emphasis added):

From an operational and strategic perspective, we were active over the first half of the year, executing on a number of exciting tuck-in acquisitions and new energy investments such as Mosaic, Net Power, and HIF Global, which position us in key technologies for the future… to capitalize on opportunities in the energy transition and industrial areas… Overall, Baker Hughes is successfully executing on its vision as an energy technology company.

Viewing Baker Hughes and the industry as energy technology investments, broadly speaking, is the correct perspective for investors. In the case of Baker Hughes, the complexity of its products and services is on display in the following slide.

In my December 2021 Schlumberger (NYSE:SLB) report, “Schlumberger is a top choice for cyclical growth through 2023,” I stated “Schlumberger is at its core a technology company.” The company is a great example of the breadth of energy transition growth opportunities. The following is a list of Schlumberger’s most visible venture investments from my April report: “Schlumberger is an asymmetric opportunity with supercycle potential.”

- NeoLith: Novel Lithium mining technology with transformative potential and a pilot project underway.

- EnerVenue: Nickel-hydrogen battery technology with proven potential that is now being deployed.

- Genvia: Electrolyzer technology used to produce hydrogen with zero emissions, pilot projects underway.

- Celsius Energy: Proven building-scale geothermal energy technology that is being deployed.

In summary, the early-stage cyclical upturn in the oil and gas sector will be amplified by a diverse set of secular growth opportunities resulting from the global energy transition.

Consensus Growth Estimates

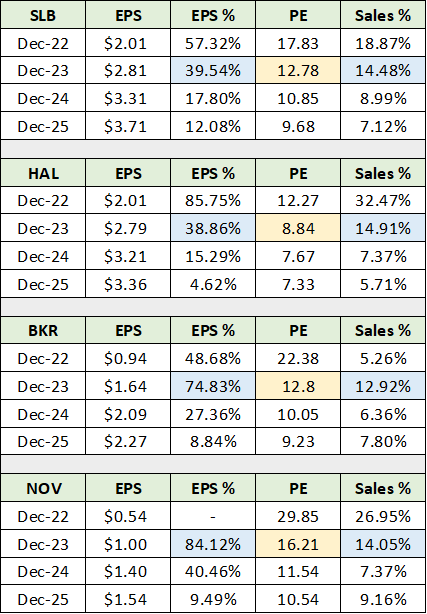

Growth estimates for the energy services and equipment industry are in line with the bullish fundamental backdrop discussed above and could prove conservative. The combination of cyclical and secular growth opportunities is likely to introduce upside surprise potential into mid-decade. The table below, compiled from Seeking Alpha, displays consensus growth estimates for four of the top companies in the industry: Schlumberger, Halliburton, Baker Hughes, and NOV.

I have highlighted in blue the 2023 consensus earnings and sales growth estimates and in yellow the associated PE multiples. The estimated earnings growth rates across the industry are impressive while the valuation multiples are a fraction of the broad market. Additionally, earnings estimates are being reduced broadly across the economy which greatly enhances the relative attractiveness of the energy services and equipment industry.

Sector Detail: OIH

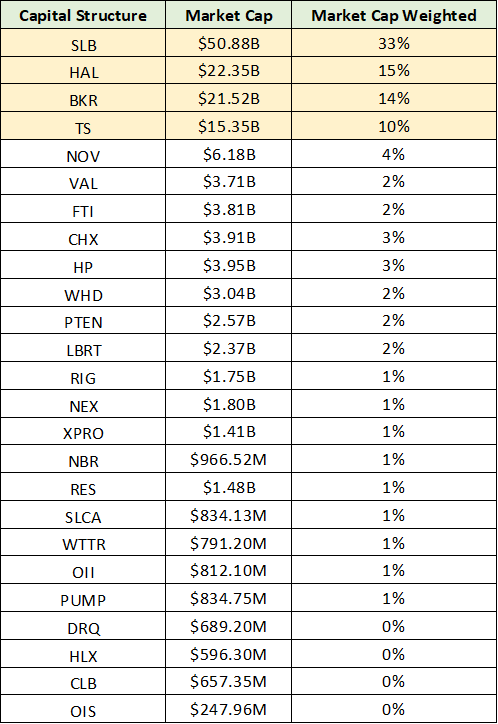

An interesting feature of the industry is the lack of investable options for larger institutions. The following table displays the components of the VanEck Oil Services ETF (NYSE:OIH), weighted by market capitalization. I have highlighted in yellow the companies that are large enough to absorb sizeable investment flows.

The industry is primarily composed of small and mid-cap stocks that are traditionally found in value funds, though they qualify as a top choice for most growth funds today. The total market cap of the above companies is $150 billion, less than many individual companies today.

For example, Exxon Mobil (NYSE:XOM) is valued at $364 billion. The entire energy sector, of which the services and equipment companies are a small fraction, comprises only 4.5% of the S&P 500. The relative outperformance potential of the energy services and equipment industry is extraordinary. If significant investor flows enter the sector, as fundamentals suggest is likely, the tiny market cap of the industry creates the potential for explosive upside asymmetry.

Technicals

The technical backdrop speaks to the upside potential. The following 20-year monthly chart of the VanEck Oil Services ETF captures the carnage in the sector. One would be hard pressed to find a worse performing industry over the past two decades.

VanEck Oil Services ETF 20-year monthly chart. Created by Brian Kapp using a chart from Barchart.com

Please note that the green lines represent a major support zone while the orange lines represent the primary resistance levels. The following 5-year weekly chart provides a closer look at the technical setup.

The industry is testing the upper end of what should be an incredibly strong support zone. It was primary resistance following the COVID crash and negative oil prices, then quickly became strong support into 2021. The upper end of this zone is highly likely to offer exceptionally strong support as the strong fundamentals render the lower end of the range as unlikely to be tested.

Summary

From a technical and fundamental perspective, the energy service and equipment industry has reached an ideal accumulation zone. The unique nature of the current cycle has created historically bullish operating conditions for the industry with volume growth and pricing power likely to persist for the foreseeable future. With the global energy transition entering a new phase, the early-stage cyclical upturn in the oil and gas sector will be amplified by a diverse set of secular growth opportunities. The energy services and equipment industry is a top choice for the coming cycle.