Risk/Reward Rating: Neutral

RH (NYSE:RH) offers one of the largest growth opportunities in the consumer discretionary sector. This fact, in addition to its visionary CEO and success to date, should place RH on the watchlist of all growth stock investors. As a result, we are adding it to the dox it! list.

Most would agree that the home furnishing retail industry offers one of the more mediocre long-term outlooks from the perspective of economics, competition, and cyclicality. The industry is littered with mature and long struggling retailers such as Bed Bath and Beyond (NASDAQ:BBBY).

The unusual nature of the RH opportunity is exemplified by the inconsistency between the above paragraphs. How can one of the largest consumer discretionary opportunities of our time be found in one of the more structurally challenged industries?

Vision

RH is led by Gary Friedman, Chairman and Chief Executive Officer. In his investor letters and conference calls, I have found him to be refreshingly honest and direct in his communications and leadership approach. He calls it like he sees it.

Like many visionaries, Friedman has constructed a vast and bold vision for the RH brand. His leadership is a competitive advantage. That said, bold and visionary leadership can amplify risk. The following section summarizes the company’s growth strategy and market opportunity.

Strategy

RH’s long-term strategy is to build the world’s first consumer-facing architecture, interior design and landscape architecture services platform. The key word is “platform” which is the RH brand. The core of the strategy is to open design galleries in every major market. The company believes this will unlock a market opportunity of $5 to $6 billion in North America, and $20 to $25 billion globally. RH’s new design galleries feature an integrated hospitality experience including restaurant and bar concepts. Keep in mind RH is currently valued near $8 billion.

On the Q1 2022 conference call, Friedman provided color as to how the core gallery concept has evolved over time. The company’s early stores generated annual sales in the low $2 million range. Today, the average newer gallery is producing annual revenue of roughly $15 million. With the company on the verge of its biggest product rollout ever, RH Contemporary, annual sales per gallery is likely to continue higher. The pricing for the new RH Contemporary product line is projected to be 30% to 35% higher than its current RH Modern lineup.

Strategy Details

The growth strategy includes moving the RH brand beyond curating and selling products to conceptualizing and selling spaces. For instance, the company is launching RH Residences. These are fully furnished luxury homes, condominiums and apartments. The North American housing market is roughly 10x the size of the home furnishing market. Additionally, the company is launching RH Guesthouses for those seeking privacy and luxury in the hotel or short-term stay market in North America, thereby targeting a $200 billion market opportunity.

For a sense of the risks from such a vast and bold vision, the company is now offering experiential services via two private jets and a luxury yacht. These services involve large expense capital assets with questionable scale potential. The two experiential offerings expose RH to large loss potential if the assets are underutilized. This speaks to the potential for amplified risk with a visionary CEO, especially when taking on many growth projects at once.

The RH Brand

The above strategy overview provides a glimpse into answering the primary question for the RH investment case: how can one of the largest consumer discretionary opportunities of our time be found in one of the more structurally challenged industries?

RH is moving away from the pure home furnishing industry. It is branching out into much larger markets thereby vastly expanding its market opportunity. The luxury market offers superior economics and remains wide open for the RH brand. To paraphrase Friedman, RH is climbing the luxury mountain in an industry which features those with taste and no scale, and those with scale and no taste.

Expectations

RH is extending its luxury brand into much larger consumer discretionary industries. These non-furnishing industries offer much of the extraordinary upside potential envisioned by Friedman. As a result, it will be informative to take a summary look at growth expectations for RH in comparison to a home furnishing industry leader.

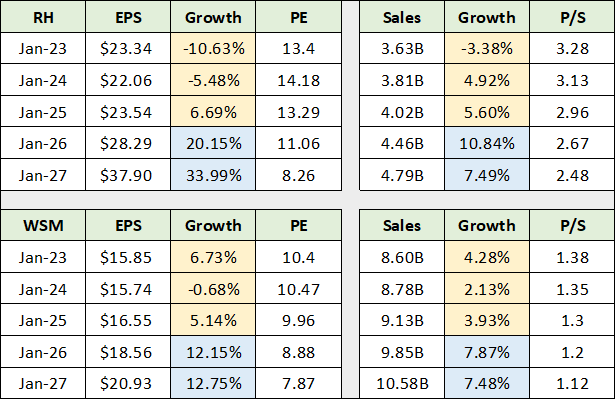

Williams-Sonoma (NYSE:WSM) is a leader in the home furnishing industry and serves as the best comparable company. The following table displays the consensus earnings and sales growth estimates for both RH and Williams-Sonoma into 2027. The data was compiled from Seeking Alpha.

The important thing to keep in mind when viewing consensus growth estimates is that RH has a completely different vision and growth strategy than Williams-Sonoma. I have color coded the consensus growth rate estimates for each company to illuminate the similarity of market expectations.

Notice on the right-hand side of the table that consensus sales growth rates for each company are identical for all intents and purposes. This fact suggests that there is potential for surprises from RH in relation to consensus estimates. Essentially, the market is not pricing in success for RH’s various non-furnishing growth endeavors.

Importantly, note that consensus earnings estimates on the left-hand side of the table diverge materially in the 2026-to-2027-time frame. This highlights a competitive advantage for RH, its business model opens the door to well above-average profit margins enabling earnings leverage in relation to the peer group. The RH business model advantage is also reflected in the P/S or price-to-sales valuation for each company. RH is valued at 3.3x sales compared to Williams-Sonoma trading at 1.4x sales.

Business Model

Friedman made an insightful observation on the Q1 2022 earnings call in regard to the RH business model advantage. I will paraphrase his observations here. The key observation is that spending on the home at the high end of the market is exponential.

This is not to imply that growth in luxury furnishing spending is literally an exponential function, but that it is exponential in relation to the mid and lower tiers of the market. Meaning, wealthier consumers spend exponentially more on their homes than do the mid and lower end consumers. Spending grows exponentially as one moves through the consumer spectrum from the low end to the high end.

The dynamics are similar to the wealth distribution in society which is greatly skewed towards an exceedingly small group at the top. The luxury end of the market offers extraordinary profit margin potential while the remaining tiers feature poor economics, intense competition, and are highly cyclical.

Asset Price Dependence

RH was one of the first retailers to report rapidly slowing consumer demand in March 2022. This hints at a unique risk factor for RH investors, the company’s luxury consumers are heavily dependent on asset prices. A prolonged bear market would likely take a heavy toll on demand for RH’s bold vision. A good time to do a full dox on RH may be near the conclusion of the current bear market in asset prices with particular attention paid to real estate prices.

Technicals

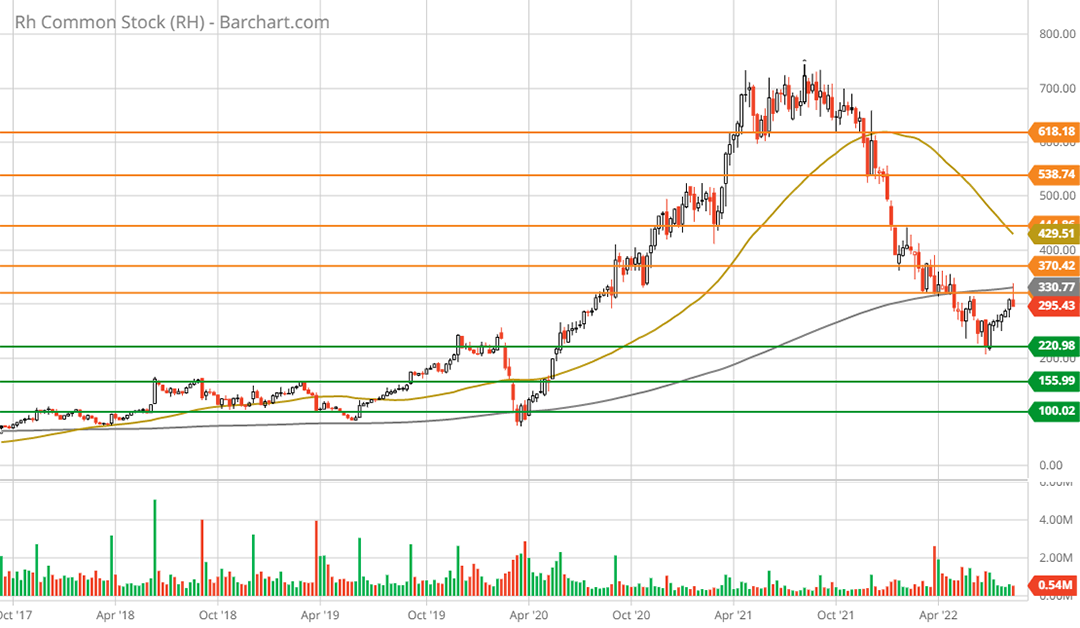

The technical backdrop speaks to the bear market in RH shares. The following 5-year weekly chart captures the essence of the technical setup. Please note that the orange lines represent resistance levels (potential sell levels) while the green lines represent support levels (potential buy levels).

Notice that the shares are currently being rejected at the first resistance level near $330. This level also coincides with the 200-week moving average (the grey trend line). The zone between the first two resistance levels is likely to cap the upward price action near $370 in the short term (the second resistance level).

On the downside, the $220 level down to $200 is likely to serve as strong support barring a deep and prolonged bear market in asset prices. If this negative asset price scenario unfolds, the shares would likely retest the lower support levels between $100 and $155. The $100 level served as the panic low during the COVID-induced selloff. The following 1-year daily chart provides a closer look at the recent price action.

With the shares trading near $295, the technical risk/reward asymmetry is well balanced given the likely trading range of $220 to $370.

Summary

The unusual nature of the RH opportunity is captured by the question initially posed, how can one of the largest consumer discretionary growth opportunities of our time be found in one of the more structurally challenged industries? Friedman has constructed a vast and bold vision for the RH brand. Paraphrasing Friedman, RH is climbing the luxury mountain against an industry backdrop which features those with taste and no scale, and those with scale and no taste.

Given the technical backdrop, the shares are likely to remain in a trading range between $220 and $370. As a result, RH shares may offer exceptional trading opportunities in the short term. Short sellers may wish to look elsewhere as RH has a tight share count and an aggressive share buyback authorization.

Though the initial risk/reward rating is neutral, RH is one of the larger asymmetric risk/reward opportunities of our time. The luxury brand packaging creates exceptional upside potential as goodwill, or brand equity, is often the largest driver of outsized returns. The future dox will shed light on the direction of the asymmetry. In the interim, RH is facing macroeconomic headwinds which should cap near-term growth potential while increasing execution risk for its various growth initiatives.

Price as of this report: $295

RH Investor Relations Website: RH Investor Relations