Risk/Reward Rating: Negative

Peloton reported its Q4 and full year 2021 fiscal results after the market closed on August 26, 2021. It provided disappointing guidance for the coming quarter and fiscal year 2022. The forecast for the current quarter is for revenue of $800 million which was 20% below expectations. In reaction, the stock fell 8.5% the following day. Adding to concerns for the future was the announcement of a $400 price cut (a 21% decrease) to $1,495 for its original Bike. With rapidly accelerating costs throughout its supply chain, slashing product prices will lead to reduced profitability.

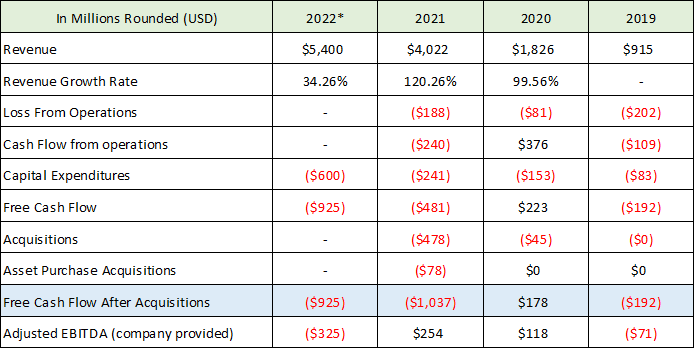

In fact, the company is projecting an adjusted EBITDA (earnings before interest taxes depreciation and amortization) loss of -$325 million in the new fiscal year. The adjusted operating loss estimate comes at a time of rapid expansion plans for Peloton as the company projects capital expenditures to be $600 million in fiscal 2022. Additionally, their fiscal year 2021 saw heavy investment in capital expenditures and acquisitions which accounted for 77% of the total -$1.04 billion free cash flow for the year. As a result, 2022 is shaping up to potentially be the second straight year of -$1 billion plus cash outflows for Peloton. The company is clearly going all in on growth which creates a heightened level of execution risk going forward.

Balance Sheet Risk

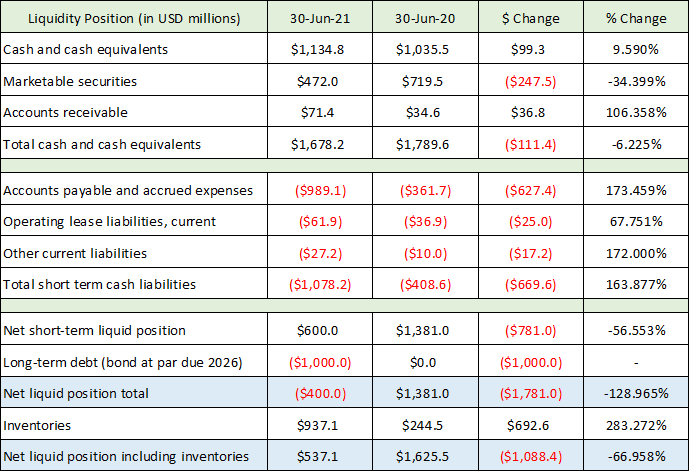

Peloton’s balance sheet may start to feel the strain from these elevated cash outflows. The company has ample liquidity at the moment with $1.6 billion of cash and cash equivalents. However, with 2022 setting up for a potential -$1 billion plus of negative free cash flow, this liquidity cushion could quickly dwindle. The following table contains data from Peloton’s recently filed annual 10-K report with the SEC and breaks down their liquidity position.

The summary data is highlighted in blue. Peloton has a negative net total liquid position of -$400 million which is a -$1.781 billion swing from one year ago and includes $1 billion of debt which comes due in 2026. Including inventories, the swing was a less severe -$1.088 billion over the past year leaving the company in a positive $537 million liquidity position. This is down from $1.625 billion a year ago (including the $1 billion 2026 debt maturity).

With the company projecting -$325 million of adjusted EBITDA for 2022 on top of -$600 million of capital expenditures, another -$1 billion of cash outflows will lead to a material degradation in the liquidity profile. Peloton took on $1 billion of debt over the past year to absorb the liquidity drain in 2021. The debt is a convertible bond with a conversion price of $239.23 per share of stock (4.1 shares for each $1,000 bond). With the share price at $104, the convertible feature of the bond is well out of the money rendering the bond pure debt at the moment. If needed, the company also has access to an undrawn $285 million credit line as of year-end 2021.

Financial Performance: Cash Outflow and Operating Losses

Peloton stated on the Q4 earnings conference call that it will continue to prioritize growth over profitability for the foreseeable future, although it expects to return to positive adjusted EBITDA in fiscal 2023. The following table breaks down key profitability metrics from the annual 10-K report filed with the SEC (*2022 revenue, capital expenditures, and adjusted EBITDA are company provided estimates while free cash flow is extrapolated). In the table below, the company’s adjusted EBITDA and capital expenditure estimates are added to arrive at a free cash flow estimate of -$925 million. Adjusted EBITDA may not be a good estimate of cash flow from operations for 2022 as it excludes many actual expenses creating the possibility of another year of -$1 billion plus of cash outflow as mentioned above.

In the Non-GAAP Financial Measures section of the 10-K , Peloton defines Adjusted EBITDA as the following:

We calculate Adjusted EBITDA as net (loss) income adjusted to exclude: other expense (income), net; income tax (benefit) expense; depreciation and amortization expense; stock-based compensation expense; transaction and integration costs; certain litigation expenses, consisting of legal settlements and related fees for specific proceedings that arise outside of the ordinary course of our business; product recall costs; specific non-recurring costs associated with COVID-19; short-term purchase accounting adjustments; impairment charges for fixed assets; and restructuring costs.)

Looking at the 2021 data, we can break down the nature of the -$1.088 billion reduction in the company’s net liquidity position as summarized in the balance sheet data table (Liquidity Position Table). Acquisitions were the largest source of liquidity drain at 54% or $556 million (important acquisition detail can be found in the notes section at the end of this report) with the remainder split evenly between negative cash flow from operations and capital expenditures.

For 2022, capital expenditures will likely dominate the cash drain at about 60%. The company is building out manufacturing capacity with a new $400 million production facility in Ohio and is also making an additional $200 million investment in technology and other infrastructure such as warehouses and last mile delivery. The estimated -$325 million of adjusted EBITDA rounds out the estimated cash drain for 2022 and is used here as an estimate of negative cash flow from operations (this may underestimate the negative cash flow from operations for 2022). Although no acquisitions are assumed, the company has become increasingly acquisitive over the past year which could be an additional cash drain if it continues in 2022.

The largest change on deck for 2022 looks to be the reduction in revenue growth to an estimated 34% gain, which is down from 100% plus over the prior two years. It should be noted that the revenue guidance for the current fiscal Q1 (ending 9-30-21) of $800 million represents only 6% growth over Q1 2021. To achieve the 34% growth target for the full year, the company will need to generate 41% revenue growth over the remaining three quarters of fiscal 2022 (ending 6-30-22). Given the growth slowdown to 6% in the current quarter, 41% growth will require a substantial increase in sales and marketing expenditures to reignite growth. In fact, on the Q4 conference call, the company stated that it will indeed ramp up marketing expenditures substantially.

Revenue Deceleration Risks

The timing of the revenue deceleration, if it were to continue, could create an elevated operational risk level for Peloton given the aforementioned heavy investments in expanded production and distribution capacity alongside the rapid weakening of the company’s liquidity profile. If sufficient demand growth does not materialize in response to increased sales and marketing expenditures over the coming year (given the company’s operating losses, negative free cash flow, and increasing fixed cost base from the aggressive capacity expansion and acquisitions) there may be a need to raise additional capital. This would likely require further share sales and shareholder dilution to shore up the balance sheet.

For example, if free cash flow comes in at -$1 billion for 2022, the net liquidity position of the company will likely turn negative when one includes the $1 billion debt maturity in 2026, which may have to be repaid in cash if the share price remains below $239.23. As things stand, the company is putting its energies into growth in the near term as getting the share price above the stock conversion price in the convertible debt will alleviate potential strains on the company’s financial position. Peloton is at a critical juncture in all respects.

Valuation

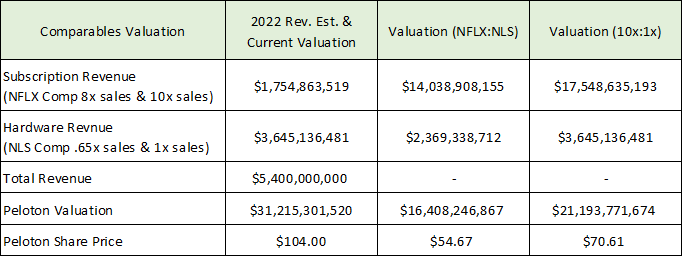

As discussed above and can be seen in the Loss from Operations in the profitability metrics table, Peloton is not profitable, nor is it projected to be profitable, while at the same time it is generating extraordinary levels of negative free cash flow. This operational reality renders a valuation difficult and dependent on a multiple of sales with acute attention paid to the balance sheet. The company is currently valued at $31.2 billion at the current diluted share count (the share count is likely to increase going forward due to employee stock-based compensation expense which will place further pressure on the price of the shares). This leaves the current valuation at roughly 6x sales. This is a high valuation given the currently unprofitable business model. For example, Nautilus is a direct competitor and is valued at only 0.65x sales. It should be noted that Nautilus was profitable last year and is trading at 6x last year’s earnings compared to Peloton at 6x sales estimates.

Peloton clearly has greater brand equity than its competitors so a direct comparison to the valuation of Nautilus and similar types of companies is not exactly an apples-to-apples exercise. The fitness hardware manufacturing business model has been a difficult one from a profitability standpoint historically as evidenced by Nautilus gyrating between earnings and losses throughout its history. The Peloton vision and business model is much more expansive than just selling hardware like treadmills and stationary bikes. In fact, the future of the company will depend heavily on its success in generating and retaining premium monthly connected fitness and digital subscription customers. Essentially, Peloton is looking to become a sort of premium Netflix for fitness with both live and on demand visual, audio, and interactive content.

One example of a valuation using comparable businesses is to value the hardware revenue at one comparable valuation and the software/subscription business at another comparable valuation. In this example, Nautilus will work for the hardware side of the business. For the software/subscription side, Netflix could be a useful comparison. The following table summarizes the results of valuing Peloton in this manner. The revenue column is the company guidance for 2022. The valuation (NFLX:NLS) column is applying Netflix’s valuation of 8x sales to Peloton’s subscription sales estimates and Nautilus’s 0.65x sales to Peloton’s hardware sales. The final column applies a 25% premium to Peloton compared to Netflix of 10x sales and a 54% premium to Peloton compared to Nautilus of 1x sales.

At the current share price of $104, based on this comparison valuation approach, Peloton is priced 47% above the pure comparison case and 32% above the premium comparison case. In the Technicals section (technical analysis), the valuations arrived at by the comparable approach here align well with key support levels for Peloton.

Subscription Business Model

The monthly subscription business model for fitness is largely untested and is likely not for the masses. For example, Peloton’s $40+ per month subscription fee rivals basic cable media packages which are being cancelled in mass today in favor of lower-priced, pay-as-you-go optionality. In the September 2020 Investor and Analyst Day Presentation, management estimated the total potential household market opportunity to be 15 million for connected fitness subscriptions (North America, UK, and Germany). The company has no estimates for how the hardware price cut of 21% will affect the 15 million addressable market opportunity except to say that they believe it will expand the total addressable market size.

Based on the lack of data in terms of the impact of the price cut on the total addressable market, the reduced pricing strategy on the original Bike is more likely an attempt to expedite market penetration of the company’s hardware in the existing target market of 15 million. This would open the door to upsell high margin subscription plans and fill the growing production capacity the company is acquiring and building. In fact, the 20% below consensus revenue guidance for Q1 of $800 million implies little to no growth in the target market size initially.

Another attempt to expedite subscription sales is the coming focus on selling treadmill hardware. The company believes the treadmill market is 2-3x the size of the stationary bike market. Recently, the company had to issue a product recall due to consumer injuries and one death related to its treadmills. The recall has delayed market penetration and been more costly than originally expected as customer treadmill returns have exceeded estimates. This underestimation of the costs suggests some potential damage to the Peloton brand. Peloton has little brand recognition in the treadmill space and expects 50% of near-term sales to be to existing customers which will have less of an impact on subscription growth as the core Peloton brand loyalists are likely subscription members already.

Finally, the company is rolling out extended payment plans (43 months with 0% financing) as a strategy to grow the user base more rapidly and pull forward subscription sales. The payment plans were already lenient, however, the new strategy along with the hardware price decrease will reduce the total monthly cost from $78 to $59 for the hardware and subscription over the financing period. The aggressive pricing strategy is a clear signal that Peloton is going all in to reaccelerate growth over the near term. It may also signal that the majority of the target market of 15 million households is at a lower price point than originally expected and that the number of early brand enthusiast adopters may have been exhausted.

Summary

The key strength of Peloton has been its brand which remains the critical fulcrum on which its future success will be determined. The company’s CEO, John Foley, confirmed this message at the end of the Q4 conference call in stating that Peloton is building one of the most powerful brands in fitness and possibly across all categories. In fact, the CEO referenced a third-party survey which ranked Peloton as the number one global brand.

I couldn’t agree more that Peloton is all about the brand. Creating and sustaining a great brand requires heavy advertising and marketing expenses in addition to consistent business execution. Peloton has demonstrated its marketing savvy in recent years generating 100% growth rates and excellent brand equity in the core fitness market, while business execution has proved more challenging in recent times.

All told, Peloton could be an excellent long-term investment opportunity if the connected fitness market can support the premium monthly subscription business model. There remains extraordinary risk across multiple time horizons. In the long term, the ultimate size of this premium subscription market opportunity remains highly uncertain. In the short to medium term, as outlined in the financial and valuation discussion, there are acute business execution risks which will be amplified if the near-term market opportunity is less than anticipated. Finally, the COVID lockdowns may have pulled forward much of the short-term growth opportunity amongst the core fitness market and brand loyalists leaving a lower growth trajectory and a higher customer acquisition cost over the coming 1-5 years than what many investors have come to expect from Peloton.

In summary, Peloton deserves to be placed on the watch list for high-risk, high-reward investors. The most rewarding strategy is likely to be one of accumulation on substantial price pullbacks which would better compensate investors for the level of risk being taken. The technical picture combined with the valuation analysis offers more attractive entry points.

Technicals

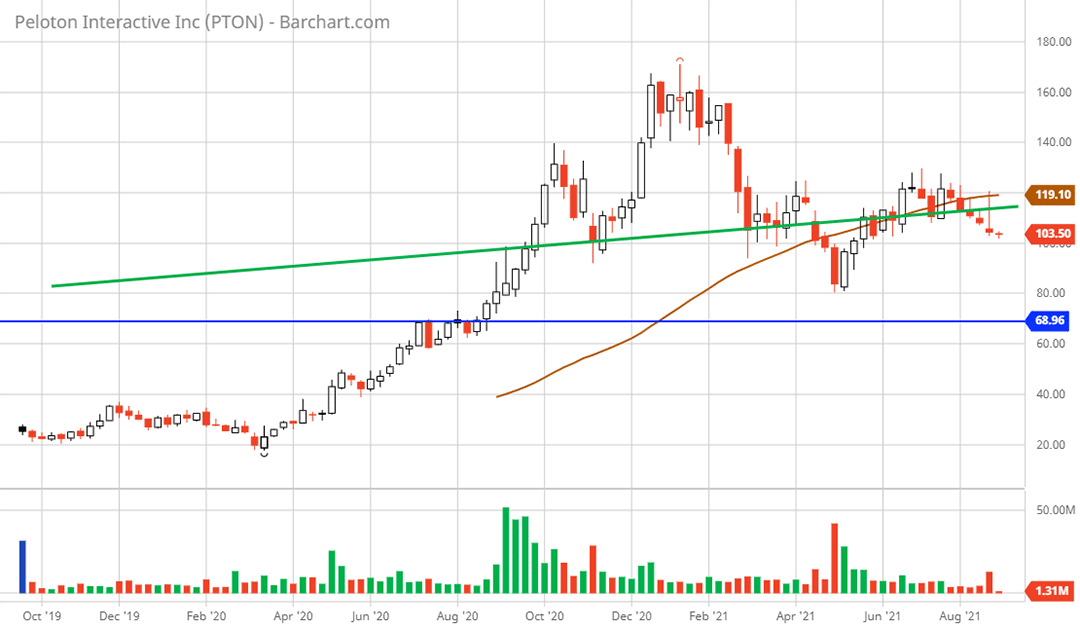

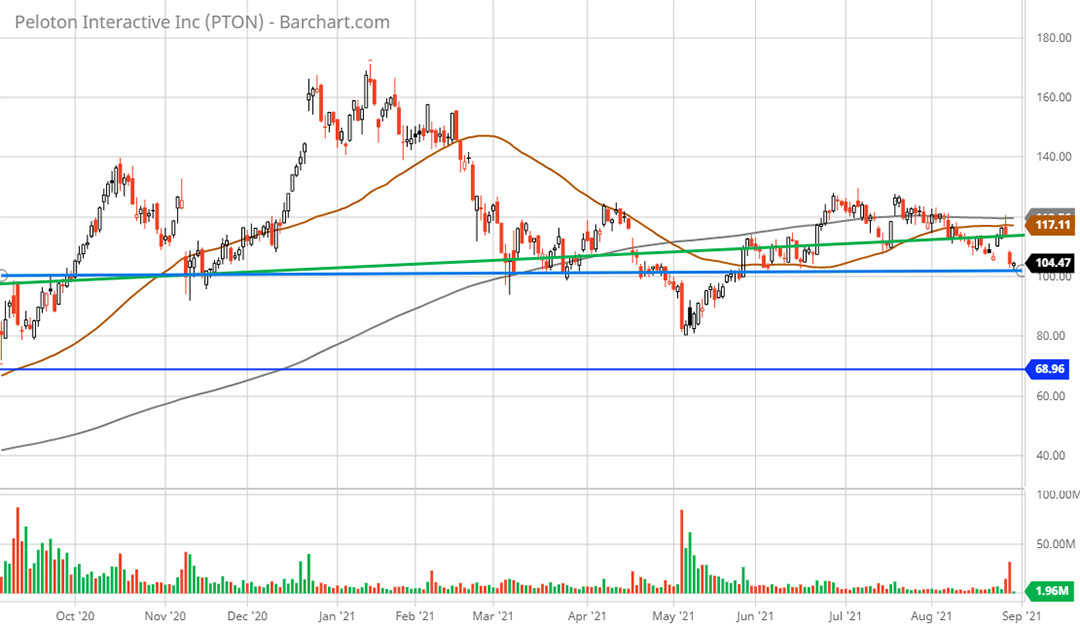

Technical backdrop: Peloton came public two years ago in September of 2019 in the $27 range and traded sideways until the onset of the COVID pandemic. The pandemic caused sales to soar as gyms were shut down and people scrambled for workout equipment. The price of Peloton exploded as a result running from $27 to a speculative blowoff top of $170 in January of 2021. Since this peak, the shares have fallen 40% and in the topping process have carved out a large head and shoulders top on the weekly chart as can be seen below.

The ascending neckline of the head and shoulders top (green line) was breached in the first week of August and served as the rejection zone on August 27 in response to the negative Q4 earnings report and weak guidance. The neckline is currently at the $115 area and should serve as stiff resistance going forward. The stock found weekly support at $83 in May 2021. The horizontal line (purple) is likely to form a stronger support area as it was a basing zone in 2020, and it aligns more closely with the comparable valuation levels between $55 and $70 outlined in the above valuation section.

Zooming in to the daily chart, another potential head and shoulders top is forming on a daily price basis. The neckline is currently near $102 (blue line on the daily chart below) and has served as a critical support level throughout the past year.

In fact, after falling 8.5% on the weak guidance for 2022, the stock found support at this line once again as it sits just above it at $104. Support here looks tenuous as a death cross has been in place since May 2021. The 50-day moving average (brown line on the daily chart above) crossed beneath the 200-day moving average (grey line on the daily chart) which signals a primary downtrend is in place. If this support level breaks, the door is opened to retesting the daily lows of May 2021 near $80. The purple line from the weekly chart remains the next lower major support level near $69. This is likely to be tested given the bearish technicals, valuation, and rapid revenue deceleration backdrop. For those looking to accumulate the shares, this would be a natural target area.

Technical resistance: The $115 weekly head and shoulders neckline should offer stiff resistance.

Technical support: The current level just above the daily head and shoulders neckline at $102 should offer tenuous support. This level has been repeatedly tested over the past year which suggests the likelihood of a break lower. Stronger support should be found closer to $69 which is the next weekly support level on a break lower and is more supported by current fundamentals.

Price as of this report 8-30-21: $104

Peloton Investor Relations Website: Peloton Investor Relations

All data in this report is compiled from the Peloton investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.

Note on the Peloton acquisitions in 2021

Given the large cash out flows from capital investments as discussed above, it is important to take note of the cash uses to gauge whether funds are being allocated efficiently and in alignment with stated objectives.

The largest acquisition in 2021 was Precor which sells an entire suite of exercise equipment into the institutional markets such as gyms and corporations. The price of the acquisition was $412 million in cash (about the cost of building the new Ohio manufacturing facility). The notable aspect of the acquisition is that Precor does not align well with Peloton’s limited product strategy (which is a few core products or SKUs) and focus on premium household subscriptions.

The company does sell globally whereas Peloton has little international exposure at the moment (90% of Peloton’s sales are in the US). The acquisition may aid international penetration for the brand which may be more skewed toward institutional settings compared to the US. The purpose of the acquisition according to the 10-K is: “The Company acquired Precor to establish its U.S. manufacturing capacity, boost research and development capabilities with Precor’s highly-skilled team and accelerate Peloton’s penetration of certain commercial markets.”

The Precor acquisition did cause Peloton’s auditors to raise a red flag in the 10-K report. They found a material weakness in Peloton’s accounting controls in regard to the identification and valuation of inventory. Anytime auditors report a material accounting weakness it is unusual, and it is wise to take note. This may be a signal of more meaningful corporate control weaknesses or may simply reflect the inexperience in the field of larger acquisitions on the part of Peloton.

Nonetheless, as can be seen in the comparable valuation analysis, the majority of Peloton’s current and future market value rests on the success of the subscription business model rather than manufacturing and selling physical equipment. It is not clear how this acquisition materially furthers the subscription business. The primary avenue would appear to be through commercial relationships and corporate wellness programs exposing end consumers to the Peloton brand and products. In essence, it may end up being an expensive form of marketing as it raises the fixed and recurring cost structure of Peloton.

The next largest acquisition was Aiqudo for $57.7 million in order to bolster product research and development capabilities. The primary area of expertise appears to be voice assistant/recognition capabilities. This acquisition is in alignment with the subscription focused business model and could play into the quality and stickiness of the Peloton software subscription business over time.