Risk/Reward Rating: Negative

Ross Stores (Ross) reported excellent Q2 earnings of $1.39 per share easily topping estimates of $.98. For the first six months of the fiscal year, earnings came in at $2.78 per share compared to $2.29 for the same period in calendar year 2019 (calendar 2020 was devastated by COVID making 2019 the better comparison). The stock was down 3% this afternoon in reaction to very weak guidance for the second half of the year.

Business Conditions

Ross Stores is one of the largest off-price apparel and home fashion retail chains in the United States, with over 1,859 locations. The weak guidance reflects the expectation of rapidly increasing expenses referred to in the last stoxdox Ross update. The company is experiencing supply chain inflation in the form of higher freight transportation and raw materials costs. In fact, the supply chain has developed bottlenecks which stretch across both highways and oceans, making it difficult to obtain and manage inventory. Additionally, Ross is facing increasing wage pressures from its workforce, which appears to be in the preliminary stages of a multi-year wage inflation cycle.

These cost pressures and supply chain bottlenecks show no signs of abating in the near term. As things stand, management has little visibility on these matters and projects that they will continue to worsen through year end and ‘bleed’ into 2022. Given that Ross serves the value-conscious consumer, it will be difficult to pass along the higher expenses by raising prices, which should place additional pressure on margins. Management confirmed this pricing reality in their Q2 results conference call and intends to maintain its low-price strategy.

The company believes it received a substantial benefit from government stimulus programs in respect to the better-than-expected earnings in Q2 and the first half of fiscal 2022. The programs delivered substantial cash infusions to Ross’s customers in the first half of the year. It is likely that substantial demand was pulled forward to the first half of the year and that second half demand will weaken. This adds an additional layer of uncertainty in forecasting the demand trend as these stimulus payments fade.

Valuation and Outlook

The company now projects earnings to come in at $4.20 to $4.38 per share for the full year (Ross currently is halfway through its fiscal year 2022). The guidance is likely conservative as analyst estimates remain above these levels. Taking the $4.38 per share high end, Ross is currently trading at 28x fiscal 2022 earnings estimates. The valuation remains elevated compared to historic market norms.

Not only is the valuation on the high end, but 28x earnings is indicative of a well above average growth company. At the current run rate for fiscal 2022, Ross’s total earnings (not per share) will come in 7% lower than in 2019 and 2% lower than in 2018. A well-established trend toward stagnating profitability is now in place even as the company continues to grow its store base at roughly 5% per year.

To offset the earnings stagnation, Ross has an active and recurring share repurchase program which has been converting the overall stagnation into earnings per share growth by shrinking the denominator. Ross plans to spend $650 million to buy back shares in 2021 and $850 million in 2022. It should be noted that the company took on over $2 billion of debt to cushion itself against the COVID impact in 2020. This is a new development as Ross has historically carried little debt on its balance sheet. Finally, the company’s CFO recently resigned to take a position at another company.

All told, Ross appears fully priced at this moment given the high valuation, trend toward stagnation, and challenging business conditions. Reasserting upward share price momentum here is likely to be challenging. On the bright side, the share repurchase program should mitigate downward share price momentum.

Technicals

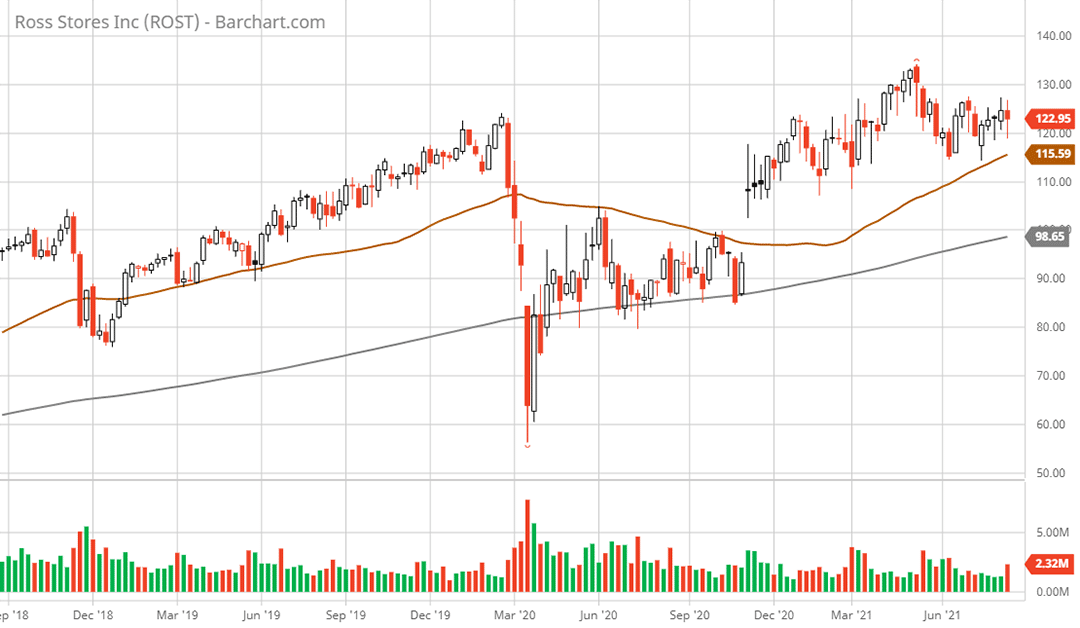

Technical backdrop: Ross has been one of the most successful retail stocks of the past decade plus, as its shares rose from $5 in 2008 to $123 today (see the 20-year monthly chart below). While the stock market averages have powered ahead since their 2019 highs, Ross is struggling to remain above its high of about $120 in late 2019. The loss of upward momentum for the stock aligns with the fundamental backdrop of earnings stagnation.

Technical resistance: The $128 level should offer resistance as it served as the rejection zone in July 2021 (see the 3-year weekly chart below). This level is also near the all-time high in the $133 area, providing additional resistance.

Technical support: The $115 area is the 50-week moving average (brown line on the 3-year weekly chart below) and has served as support throughout 2021. The next support is in the $99 area which coincides with the 200-week moving average (grey line on the 3-year weekly chart). The $99 area also represents the gap upward in November of 2020 and served as resistance throughout much of 2020 prior to the gap up. As a result, this level appears likely to be retested and may offer a potential entry point.

Price as of report date 8-20-21: $123.13

Ross Stores Investor Relations Website: Ross Stores Investor Relations

All data in this report is compiled from the Ross Stores investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.