Risk/Reward Rating: Neutral

Roblox is arguably the most exciting growth story told in the markets today as a pure play on the hottest trend, the metaverse. The company describes itself as operating a human co-experience platform where users interact with each other to explore and develop immersive, user-generated, 3D experiences. Adding to the metaverse excitement is the addition of a virtual currency called the Robux, which users purchase in order to build their virtual lives and conduct commerce in Roblox’s virtual worlds.

The company has seen explosive growth as witnessed in its Q2 2021 earnings report last evening. Revenue increased 127% over Q2 2020 to $454 million, while free cash flow from operations grew 70% to $168 million in the quarter. The impressive results were no surprise given the excitement and lofty expectations surrounding the company. Given the lack of surprise, the stock had a muted reaction to the excellent results and was down 1% midafternoon on the news. Prior to this muted stock reaction today, the shares briefly sold off 5% in after-hours trading immediately following the earnings release. This volatility was a reaction to developments in Q2 which point toward greater caution going forward.

Bookings and Revenue

The most concerning aspect in the Q2 2021 earnings report was the bookings reported by the company. First, it is necessary to understand how Roblox recognizes revenue. Generally speaking, bookings occur when customers exchange real money for Robux virtual money. The Robux money is then used on the platform to purchase virtual goods and services over time. The company recognizes revenue when these virtual exchanges occur rather than when real money is exchanged for Robux money. Furthermore, in most cases, the company recognizes the revenue from these virtual purchases pro rata over the following 23 months. This period is the average life expectancy of a Roblox customer (life as a customer that is).

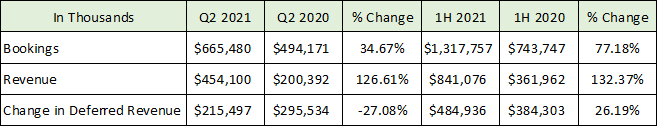

As a result, bookings are an indication of future revenue, whereas reported revenue is the recognition of prior bookings. This future revenue from bookings, not yet recognized as revenue, is accounted for in the financial statements as deferred revenue. Investors are most concerned with future trends, and in the case of Roblox, bookings and deferred revenue are the future while revenue is the past. The following table breaks down these numbers through Q2 2021.

In Q2 2021, revenue grew nearly 127% while bookings grew at just over 34%. In the first half of 2021 (1H) bookings grew 77%, much stronger than the 34% in Q2 alone. This points towards a rapid deceleration for future revenue as 2021 progresses. The company noted that bookings grew 20% in July 2021 (the first month of Q3), further confirming the slowing growth trajectory.

The rapid slowdown narrative shows up in the deferred revenue change category. In Q2 2021, deferred revenue grew by $215 million versus growth of $295 million in Q2 2020 representing a 27% decline in the dollar growth of deferred revenue. Given the dollar amount of deferred revenue grew 26% in the first half of 2021 compared to the first half of 2020, the 27% decline in Q2 confirms the rapid deceleration for future revenue growth which is unfolding.

User Slowdown

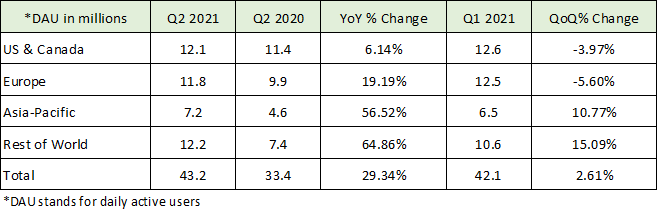

Another concern from the Q2 2021 earnings report relates to user growth in the US and Canada, which accounts for 68% of total reported revenue. As can be seen in the following table, user growth in Q2 2021 slowed to 6% compared to Q2 2020 and actually declined nearly 4% compared to Q1 2021.

Similarly, European users (who account for 19% of revenue) declined 5.6% in Q2 2021 compared to Q1 2021, though still posted growth of 19% versus Q2 2020. Roblox is currently generating its future growth in the Asia-Pacific region and the rest of the world.

It should be noted that China has begun a crackdown on online gaming, social media, and virtual reality — describing it as ‘opium for the mind’ by some accounts. Roblox has a joint venture with Tencent in China which is one of the targets of the Chinese regulatory clampdown. The Chinese have signaled that the technology crackdown will persist for many years. This is likely to retard prior growth expectations of investors over the coming 3-5 years as China remains the largest Asia-Pacific growth opportunity for Roblox.

Future Outlook

Near term growth pains aside, Roblox has exceptional growth opportunities, and the company now has greater than 50% of its users in the 13-year-old plus age category. This is in comparison to its historic focus on the 9–12-year-old market segment. There remain challenges, however, as evidenced by the rapidly slowing growth rate and the oncoming tsunami of competition.

On the competition front, Facebook recently declared its intention to become a metaverse company. In its Q2 2021 update, Facebook announced that it will spend at least $5 billion annually to transform its dominant social media platform into a dominant virtual reality platform and compete for customers’ time spent in virtual worlds. Facebook and many other large technology companies will make penetrating and retaining the 13-year-old plus market segment much more difficult for Roblox.

Turning to the valuation, Roblox is currently valued at $46 billion. This equates to roughly 23x sales at the current revenue run rate and 62x free cash flow from operations at the current run rate. Based on earnings per share estimates for 2022, Roblox is trading at 90x earnings estimates. In each case, the valuation is extreme from a historic market perspective.

All told, given the growth potential, Roblox should be on the watchlist for aggressive growth investors with a high-risk tolerance. Given the rapid growth deceleration taking place in the business, patience with a view towards opportunistically accumulating the shares on substantial price declines may be the most rewarding approach.

Technicals

Technical backdrop: Roblox came public in March of 2021 and closed the first day of trading near $70. The stock has spent the majority of its short trading history range bound between $65 and $85, excluding a short runup to $100 in May. The $85 cap on the trading range has served as recent resistance and coincides with the 50-day moving average (brown line on the daily chart). This trading range appears likely to persist until the company’s planned early August update on user activity, which will likely determine if the range is broken on the low side or high side.

Technical resistance: $85, which is the upper end of the trading range.

Technical support: $65 to $70, which is the lower end of the trading range and the IPO day price range. No lower support is visible given the short trading history.

Price as of this report 8-17-21: $78.50

Roblox Investor Relations Website: Roblox Investor Relations

All data in this report is compiled from the Roblox investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.