Risk/Reward Rating: Negative

Estee Lauder is the premier global beauty company, and its stock valuation fully reflects this fact. The company took a hit from COVID due to the closure of physical retail stores; however, it expects to get back to sales growth of 6% to 8% per year over the long-term. While this is respectable growth for a mature company, it is not what one would expect given the lofty valuation.

Valuation: 51x fiscal 2021 earnings estimates (year ends 6-30-21) and 44x fiscal year 2022 earnings estimates. The company is valued at $116 billion or over 7x sales estimates for 2021 and 6.7x 2022 sales estimates. These multiples are well outside historical market norms.

Skincare and makeup contribute the majority of sales at 52% and 33% respectively. Fragrance at 11% and haircare at 4% of total sales complete the portfolio. Global growth in skincare and makeup has been excellent the past decade and Estee Lauder has been one of the largest beneficiaries. The growth is evident in successful specialty retailers such as Ulta Beauty and Sephora in the beauty category.

This above average growth in beauty products is attributable to the millennial generation which is the largest target market by numbers. The millennials have demonstrated greater aspirational brand affinity with a focus on physical wellness compared to prior generations. These affinities are evident in tangential sectors such as fitness and brand successes such as Peloton, Lululemon and Nike. The outsized impact of millennials on above average growth rates in the beauty category has likely peaked, setting the stage for growth rates more in line with the overall global economy.

Estee Lauder is a global growth play in prestige beauty. The largest growth opportunity is in the Asia Pacific region which accounts for 25% of sales. Europe, the Middle East, and Africa account for an outsized chunk of sales at 43% while the Americas have seen declining sales in recent years and account for 32%. Given the company’s market positioning and global diversification, if the share price falls materially to a more reasonable valuation, Estee Lauder could make for an excellent purchase.

The company has a potential weak spot in the skincare market which accounts for 75% of operating income on only 52% of sales. The weak profit contribution from Estee’s other business lines creates a reliance on maintaining its premium brand market leadership position and the associated outsized profit margins in skincare. Competition for these excess margins is likely to be intense going forward.

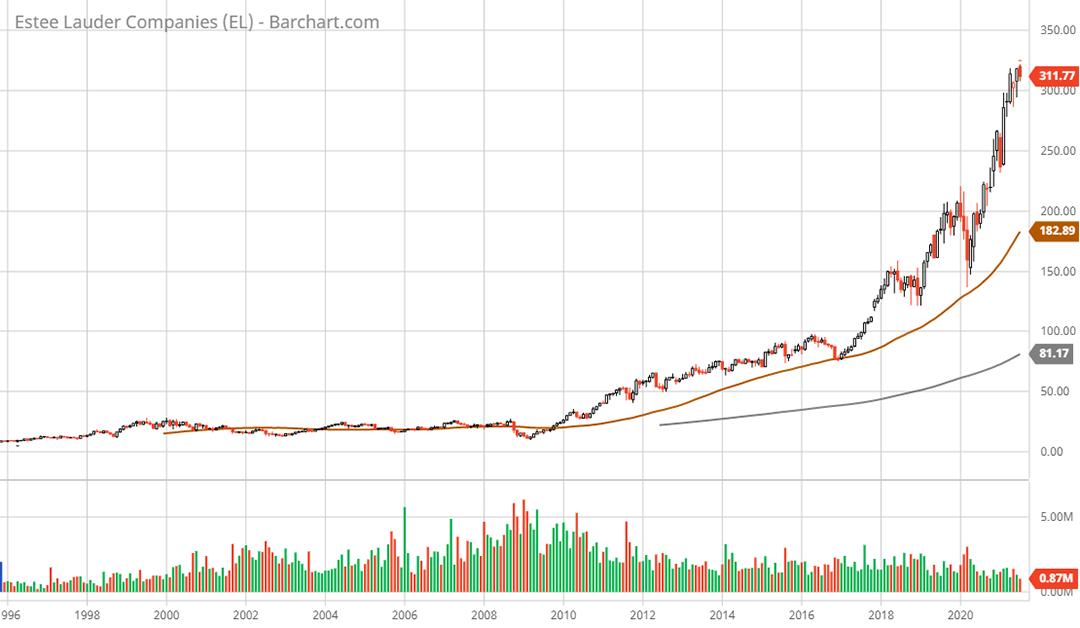

Technical backdrop: Estee Lauder stock stagnated in the first decade of the 2000’s as it worked off extreme valuation levels from the late 90’s stock bubble. Beginning in 2017, the stock price entered a new parabolic uptrend as can be seen in the max. monthly chart. The current share price is overextended to the upside which is in line with the extreme valuation today similar to the late 90’s. The 50-month moving average (brown line on max. monthly chart) sits 43% lower at $182 which represents 26x 2022 earnings estimates. This is not an unreasonable valuation level to expect.

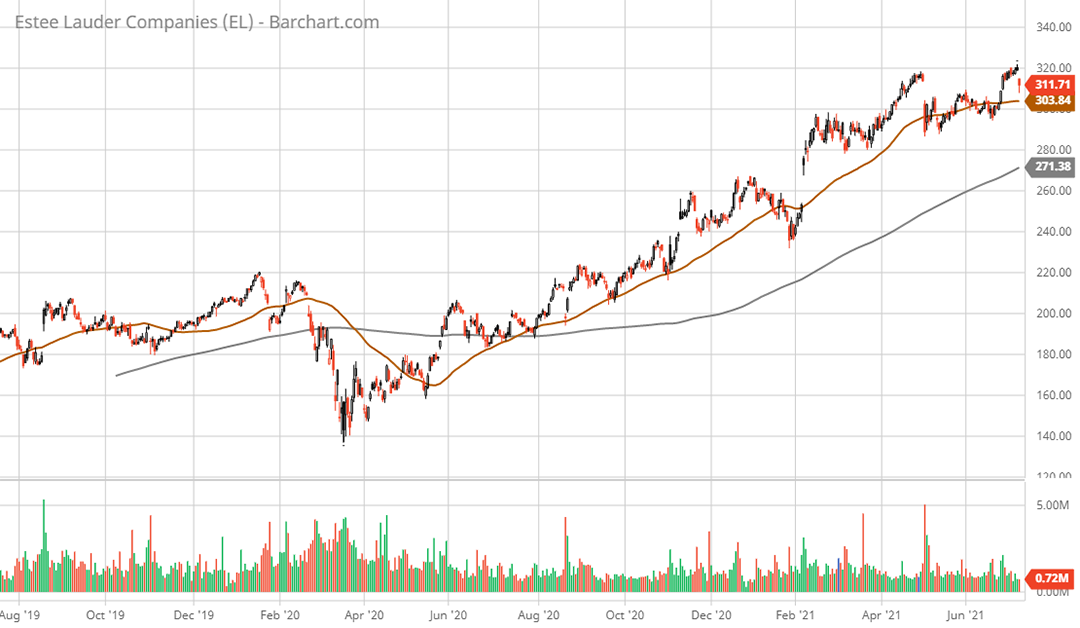

Technical resistance: Current levels up to $320 which is an all-time high zone.

Technical support: $270 area which is also the 200-day moving average (grey line on 2-year daily chart). The $220 area should offer stronger support on both the daily (2-year daily chart) and weekly charts (not shown).

Price as of report date 7-8-21: $314

Estee Lauder Investor Relations Website: Estee Lauder Investor Relations

All data in this report is compiled from the Estee Lauder investor relations website and SEC filings, and where applicable publicly available information regarding consensus earnings estimates.