Risk/Reward Rating: Negative

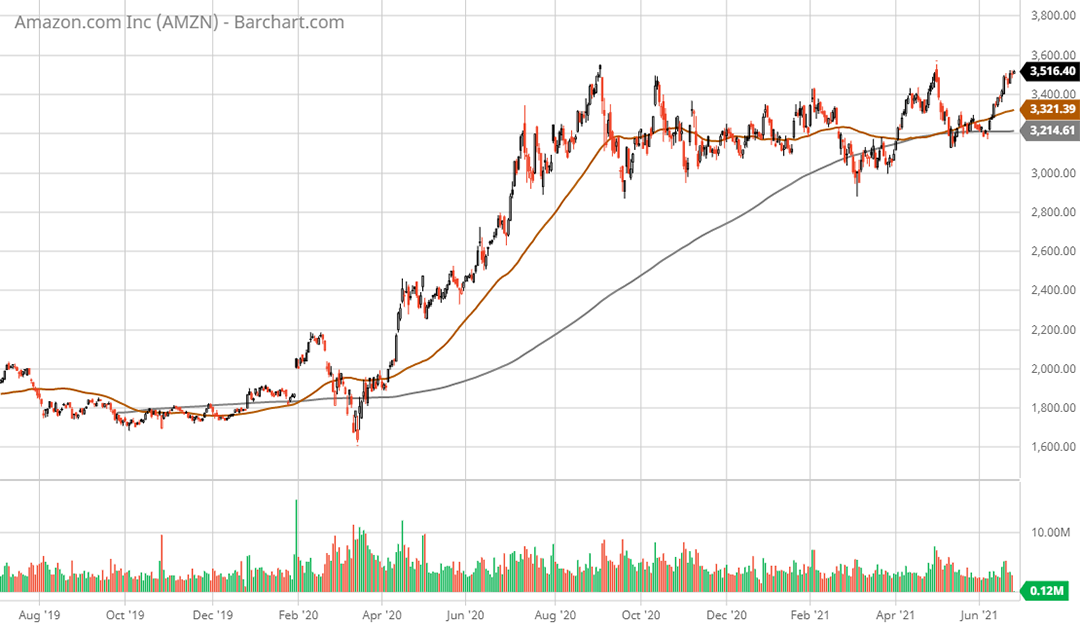

Amazon was the largest beneficiary of the COVID lockdowns by absolute revenue growth. It was the perfect storm for Amazon to take market share. This may be about to change as evidenced by the tone of the just completed Amazon Prime day on June 22, 2021, which was described as “more muted than usual” by CNBC.

Amazon’s revenue growth in 2020 was 38% or nearly double the 20% growth in 2019. The first quarter of 2021 crested at 44% revenue growth versus last year. For a company the size of Amazon, this is an incredible rate of change. The problem for the stock is that the 20% and decelerating sales growth pre-COVID may be more indicative of the sustainable business prospects outside locking down the world’s population for an entire year. The increasing likelihood of a reversion to normal revenue growth sets the stock up for disappointment when reporting results compared to the bumper year of COVID sales.

Valuation: 152x 2020 actual earnings, 63x 2021 earnings estimates, and 48.5x 2022 earnings estimates. Earnings in 2021 are expected to grow 142% while earnings in 2022 are expected to growth 30%. The extraordinary growth expected in 2021 runs the risk of extrapolating recent growth rates which occurred during a perfect and unusual time for Amazon. Such lofty expectations set the company up for disappointment and downside surprises.

Trends in the broader economy also pose significant risks to Amazon. The most pressing risk is wage inflation and employee related expenses. To meet the extraordinary demand during COVID, the company hired 500,000 new employees in 2020 and the trend continued in the first quarter of 2021. Tight labor markets, increasing supply chain expenses, and the threat of revitalized union activity are likely to crimp already tight profit margins in many of Amazon’s businesses.

Amazon’s operating profit margin before tax was 8% of sales in Q1 2021. A more normalized level pre-COVID was in the low 5% range which is likely to be revisited with slowing sales and rapidly rising costs. This reversion to normal creates a significant risk for earnings disappointment going forward.

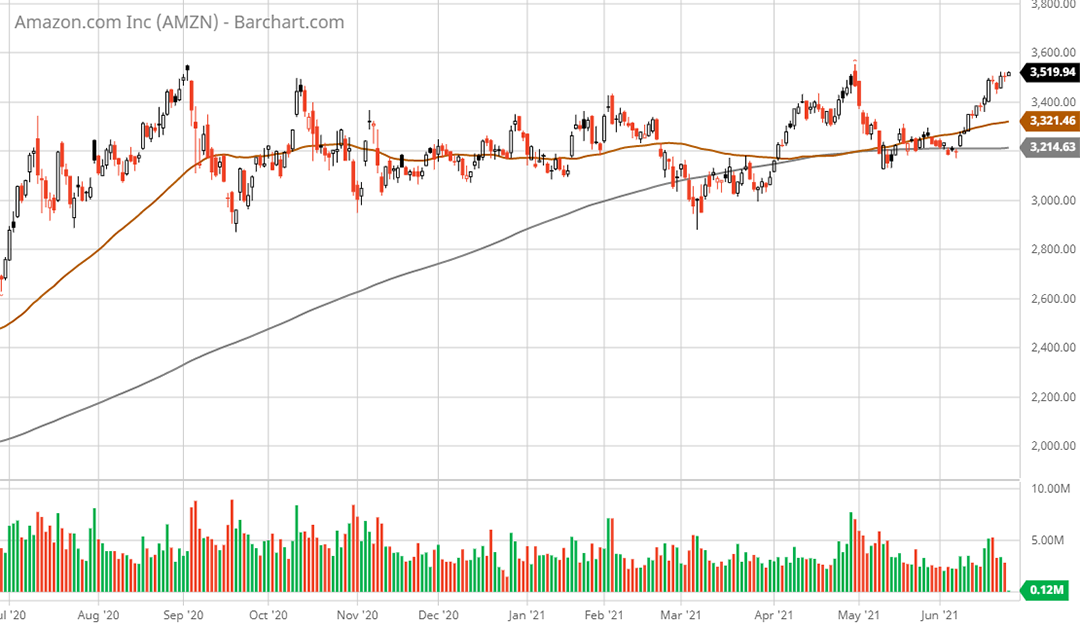

Technical resistance: $3,565 which is at new all-time highs and has served as the top of the range for the stock the past nine months.

Technical support: $2,900 to $3,000 area which has served as the bottom of the range for the stock over the past nine months. Next lower support area is $2,200 to $2,400 should the company disappoint.

Price as of report date 6-24-21: $3511

Amazon Investor Relations Website: Amazon Investor Relations