stoxdox: Primary Research Reports

Primary research reports anchor the stoxdox service. The reports feature a comprehensive fundamental analysis, a broad technical overview, and a potential return spectrum with associated price targets when appropriate. A key feature of our primary research is the risk/reward rating which can be either positive, neutral, or negative. Or 1, 2, and 3 in the stoxdox – Portfolio Tool, respectively.

The primary research reports are constructed as an intermediate-term foundation and are designed to be an extended framework for approaching each investment opportunity through time, thereby serving as a decision support tool. We call each of our primary research reports a “dox,” hence our slogan: “You’ve got to dox your stocks!”

I will guide you through a primary research report below while relating the various use cases back to the stoxdox – Portfolio Tool.

Salesforce is an excellent example of the stoxdox platform design. We serve the entire risk/reward spectrum, from conservative/income-oriented investors through aggressive/growth-oriented investors. Enabling maximum use cases across the investor universe. In the case of Salesforce, a widely held stock, the primary research report highlights the unbiased and objective nature of the stoxdox platform.

Salesforce scores a (3) for its negative risk/reward rating and a (2) for its average risk or ē in the stoxdox – Portfolio Tool. On the income score or Ʃ+, Salesforce receives a below average score (3) due to its lack of dividend. Please note that ratings of (1) through (3) are always from best (1) to worst (3).

Salesforce, Inc.

Report date: August 27, 2021

Risk/Reward Rating: Negative

Price as of the report: $273.14

Price at 11-9-21 peak: $311.75

Price at 5-20-22 low: $154.55

stoxdox price target: $168

Price today, 7-22-22: $183.11

Asymmetric risk/reward opportunity:

- Maximum upside since report: 14%

- Maximum downside since report: -43%

Report Excerpts And Use Cases (italics added):

Excerpt: The growth was driven by the recent acquisitions of Tableau and MuleSoft which dominated the top ten largest customer wins in the quarter… Saleforce’s core Sales Cloud revenue grew 15% in the quarter which, while still respectable, is decelerating as hypergrowth is in the rearview mirror…

Growth Strategy Risks

Salesforce has increasingly turned to acquisitions to maintain revenue growth… The risk for Salesforce’s stock resides in replacing organic revenue growth with acquired revenue growth… the growth becomes lower quality… lower valuation multiple risk is amplified when the acquisitions are made at extraordinary valuations…

This is evidenced by the most recent acquisition of Slack… Salesforce purchased Slack for $27.7 billion which equates to an incredible 26x… revenue… Slack revenue growth has slowed to 39% in Q2 2022… Historically speaking, it is exceedingly difficult to generate attractive long-term returns on an investment when one pays 26x sales…

Use Cases: This excerpt highlights the universal use cases that the stoxdox platform is designed to serve and the competitive advantage we strive to deliver to our members. The primary research reports go beyond the numbers and hype, providing insight into the business model of each investment opportunity. Our experience and strong foundation in strategic management and economics offers a uniquely full-spectrum, full-cycle, and global perspective.

Salesforce’s growth strategy introduces valuation compression risk as the company is following a well-trodden pathway common to maturing growth stocks. The risk emanating from Saleforce’s growth strategy introduces the key variable to the Salesforce investment case, valuation. This information provides invaluable context when viewing the opportunity set in the stoxdox – Portfolio Tool.

Salesforce’s stage of maturity aside, software companies offer some of the greatest growth opportunities in the market. In the stoxdox – Portfolio Tool, sort by sector, then industry, and then dox % ∆ descending to find top performing software stocks.

Excerpt: Financial Results and Valuation

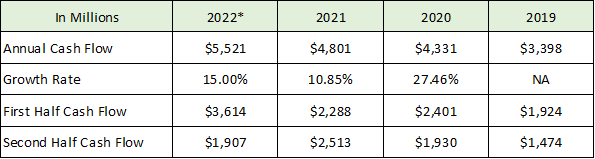

Turning to the bottom line for Salesforce becomes tricky due to the company’s heavy use of adjustments to GAAP… The cash flow from operations is unadjusted and a good place to start…

Cash flow from operations is on pace to average 13%… 13% growth is a material deceleration and on an absolute basis is not indicative of a hypergrowth company… In summary, Salesforce is valued at 58x expected 2022 free cash flow…

The Income Statement

Incredible valuation based on operating income at 580x. This is GAAP operating income and includes stock-based compensation expense and amortization of intangibles…

Use Cases: With valuation identified as the key variable for the Salesforce investment case, the primary research report begins to reveal the valuation to be extreme in all respects. The negative risk/reward rating, or (3) in the stoxdox – Portfolio Tool, is now becoming animated for our members.

Our holistic, integrated, and broadly diversified research approach is designed to maximize value across the universe of investor use cases. Brian is the primary stoxdox author. Being an analyst and an experienced portfolio manager with 26 years of experience and wisdom across the broad global markets is a key differentiator. The analyst side enables the creation of the highest quality, comprehensive, unbiased, and professional analysis. The portfolio manager enables the design and delivery of the information in an actionable format for the broad universe of investors.

The cyclic nature of the market dictates that the best opportunities and the greatest risks at any given moment will rotate throughout the spectrum of features (growth, value, income, etc.). This is a competitive advantage offered through the stoxdox platform. We empower members with a continual stream of opportunities, from current income through extraordinary growth companies, curating top opportunities for all market cycles.

Excerpt: Income Adjustments

Turning to the adjustments… Using the non-GAAP numbers, the valuation is 62x earnings which is high by historical standards…

The amortization of intangibles is tricky. While a case can be made to expense some of it, the reality is that it is subjective and requires a case-by-case treatment. In the Slack acquisition for example, expensing is likely justified as the acquisition value was extraordinary…

In terms of the real economics of the situation, share-based compensation is an actual economic expense. To exclude this expense in its entirety is to ignore the economic reality of the situation…

If we exclude intangible amortization… but keep stock-based compensation expense… Salesforce’s operating income margin is estimated to be 7.9% of revenue. On this basis, Salesforce is currently valued at 151x operating income. This is an extreme valuation… if we exclude one-third of the stock-based compensation expense, assuming it provides an employee incentive value that cash compensation would not, the valuation comes in at 91x… which again is historically an extreme valuation…

Use Cases: This excerpt gets to a core feature of the stoxdox platform and the universal investor use cases. The stoxdox platform is designed for all investors in search of the highest quality, unbiased, professional analysis delivered in an actionable format.

The specifics of the above excerpt illuminate the competitive advantage offered through the stoxdox platform. While most investors receive only adjusted earnings and valuation figures from the financial media, stoxdox members have access to an objective overview of each company’s actual earnings power. The difference for investors cannot be overstated.

Our mission is to empower you. Only you have the power to set and achieve your goals. Only you know your situation and risk tolerance. Our research is designed to empower you because information is power. stoxdox filters the noise.

All investors benefit from objective, unbiased, professional analysis delivered in an actionable format.

Excerpt: Technicals

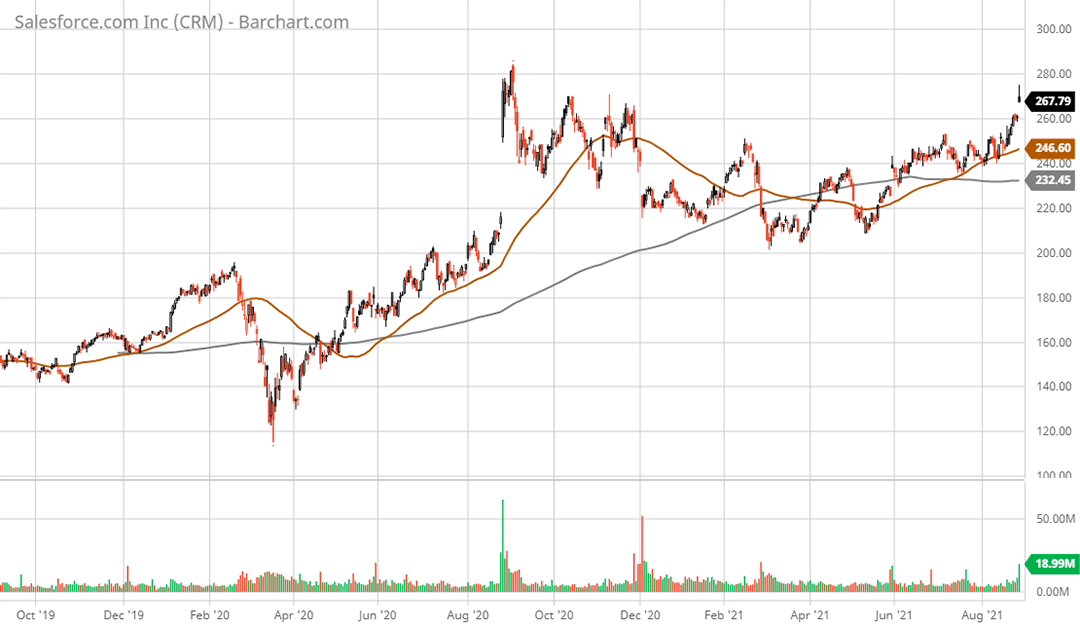

Salesforce is attempting to reestablish upward momentum. The 50-day moving average (brown line on the 2-year daily chart below) crossed back above the 200-day moving average (grey line on the daily chart) on July 15, 2021… the opposite had occurred on March 18, 2021… Given the valuation, this seesaw action is likely to persist…

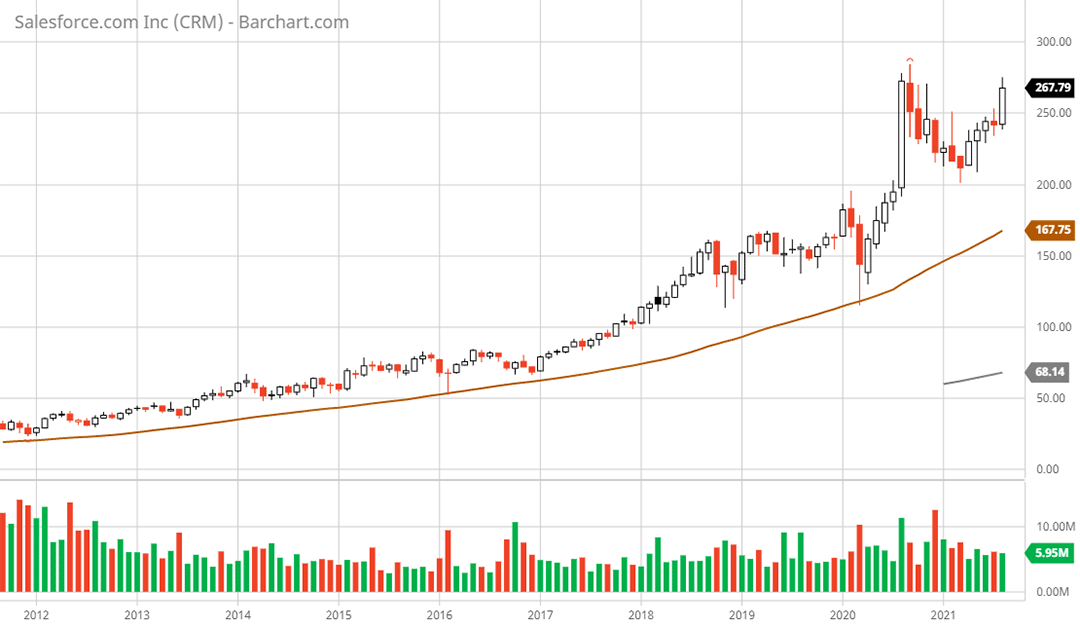

Zooming out to the 10-year monthly chart, Salesforce has repeatedly touched the 50-month moving average (brown line on the 10-year monthly chart) which now stands at $168… Against the valuation backdrop and growth strategy discussed above, a reconnection with this long-term moving average is likely at some point.

Use Cases: This excerpt speaks to the essence of the stoxdox platform. We curate the most asymmetric, relevant, and timely risk/reward opportunities of our times. The technical analysis section of our reports becomes animated when combined with the fundamental analysis which precedes it.

A common error many make is to view only fundamentals or only technicals when weighing an investment opportunity. For example, the technical backdrop above is quite bullish for Salesforce in isolation. The shorter-term daily chart suggests a resumption of the upward momentum which is clearly visible on the longer-term weekly chart.

When technical analysis is combined with the fundamental analysis, a decidedly negative risk/reward asymmetry is revealed for the Salesforce investment opportunity.

The use cases for technical analysis cover the entire investor spectrum and every investment decision. All investors must consider the price behavior of each opportunity as it contains the message of the market at any given moment. That said, price behavior on its own is meaningless for all but pure trading use cases. Even here, traders that are informed by the fundamentals in addition to the technicals have a distinct competitive advantage as can be seen in the case of Salesforce.

This is the competitive advantage offered through the stoxdox platform. Our information is designed to be actionable for those with longer-term holding periods as well as those with shorter-term holding periods as the shelf life of our primary stock reports is intended to be long. The primary research reports are constructed as an intermediate-term foundation and are designed to be an extended framework for approaching each investment opportunity through time, thereby serving as a decision support tool for all investors.

Excerpt: Summary

Salesforce… expects to achieve $50 billion of revenue by fiscal year 2026… will likely require several large acquisitions which exposes the company to the valuation risk discussed above… As an example, this sales goal would place Salesforce in the same size category as Oracle who also turned to acquisitions… Oracle today is valued at 19x earnings and 6x sales. If one were to apply Oracle’s 6x sales valuation to the $50 billion Salesforce target, it would place the market capitalization of Salesforce at the end of fiscal year 2026 roughly where it is today.

All told, Salesforce is a great company with a stock price that is fully valued… The risks outweigh the rewards at the current price as there is little excess return potential left on the table.

Use Cases: We have designed our full suite of services, in addition to the primary reports, to offer members an incredible value proposition. This is a competitive advantage offered through the stoxdox platform. We empower members with a continual stream of opportunities, from current income through extraordinary growth companies, curating top opportunities for all market cycles.

The primary research reports and snapdox summary reports underpin the stoxdox – Portfolio Tool. It is designed to empower you by providing a continuous stream of actionable information across our entire research universe. Please let us know if you have any questions, it is an invaluable tool for maximizing your membership value.

You have the power.